Lessons Of The Best Investors: The Path To Success

Which characteristics in investments philosophies do succesfull investors share and how do we have the biggest chance to outperform the markets?

Welcome to Compound & Fire! We search for businesses which create strong shareholder value over time in order to get financial independence and retire early. Join for free if you haven’t subscribed yet.

Source: Image by evening_tao on Freepik

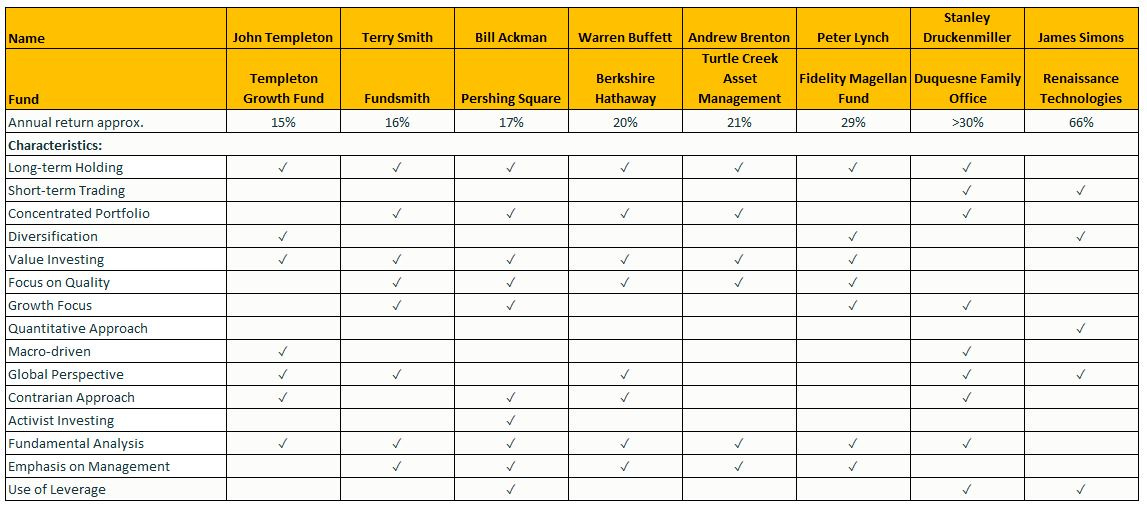

There are multiple well-known investors that have outperformed the stock markets over time. What was their investment philosophy? Do they share the same philosophy or is it completely different? I have selected eight investors of whom I knew they have outperformed the markets. In the table below you will see their names, the fund they (had) run and the characteristics of their philosophy.

The annual returns shown in the table can’t be really compared, as one investor managed to get these returns for decades (like Buffett), while for others the time frame was shorter (like Lynch - 13 years). But at least it indicates they have outperformed the markets over a certain period in time.

It is interesting to see that James Simons (who unfortunately recently passed away) and Stanley Druckenmiller are the best performers, while they stand out for their more dynamic, macro-driven or quantitative strategy. Simons is als the only one not heavily relying on fundamental analysis. Although the returns of Simons are unmatched, the strategy is almost opposite of my own strategy and I can’t and don’t want to base my investment decision on a quantitative approach.

The characteristics that recur most often in the table:

Long-term holding

Concentrated portfolio

Value investing and focus on quality

Global perspective

Fundamental analysis

Emphasis on management

For me it’s good to see all these characteristics are part of my investment strategy, which you can find here: Investment strategy Compund & Fire.

The individual philosophy of these investors and their key take-aways can all be captured under these characterics, but like to add a couple of different investors:

Buy good companies

Don’t overpay (margin of safety)

Patience and discipline / Do nothing.

Understand the business

Competitive advantage (moat) / highly intelligent companies that are best in class

Aim for tenbaggers

Pay attention to insider ownership

Avoid hot stocks (popular stocks) / don’t follow the crowd

Risk management focus - figuring out potential losses upfront

Avoid excessive conservatism in making forecasts

I realize more and more the importance of insider ownership and an owner operator leading the company. The interests between shareholder and management need to be aligned, which potentially leads to better decision making. CEO’s running a company temporarily and receiving compensation based on short-term metrics and diluting the number of shares is mostly not in the interest of shareholders.

A study published in The Journal of Finance found that a portfolio of owner-operator companies outperformed low-ownership firms by more than 4% annualized over several decades from the 1980s to 2010s.

I think this is a very good read about the owner-operator advantage: Principal Asset Management

If there is no owner operator in a company, then at least the company should have a wide moat.

Source: Morning Star Equity Research

The table below is showing that companies with a wide moat have outperformed the markets annually by 3.27% since inception. That is significant.

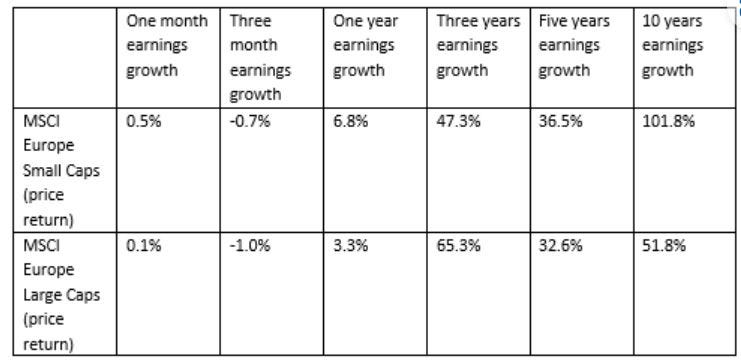

When comparing small caps to large caps we can see that MSCI Europe Small Caps have outperformed MSCI Europe Large Capts last 10 years.

Source: AXA IM as of December 2023

Also opportunities for mispricing in small caps are higher versus largecaps:

Less analyst coverage

Lower liquidity

Less institutional interest

Information asymmetry

There is also a greater potential for an edge. Thorough research on small-cap stocks may result in an informational advantage more easily than with large-cap stocks. As Warren Buffett is saying, "I don't look to jump over 7-foot bars, I look around for 1-foot bars that I can step over.”

Conclusion

If we combine the most recurring characteristics of a group of great investors with buying owner-operator companies or wide moat companies and we prefer small or midsized companies over largecaps, then the chance to outperform the markets increase. Isn’t that what we all try to achieve?!

Hopefully you have enjoyed this update of my portfolio. Feel free to like the post and share it with friends!

P.S. I was happy to read that Andrew Brenton of Turtle Creek add Kinsale Capital Group last quarter. This is one of my top picks in the Compound & Fire portfolio.

Disclaimer

The information in this article is provided for informational and educational purposes only.

The information is not intended to be and does not constitute financial advice or any other advice, is general in nature, and is not specific to you. Before using this article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

None of the information in this article is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The author is not responsible for any investment decision made by you. You are responsible for your own investment research and investment decisions.

great ! I was listening lately to some podcast of Druckenmiller. Really took some huge bets and learned a lot from Soros.

Druckenmiller stated that his job for 30 years was “to anticipate changes in economic trends that were not expected by others, and thus not yet reflected in security prices.

“Concentrate on the future rather than the past. He used also technical analysis.”