Portfolio strategy Compound & Fire

Every investor needs a strategy to commit to. Investing without a strategy will impact your returns. Discover the investment strategy of Compound & Fire.

Welcome to Compound & Fire. I search for businesses which create strong shareholder value over time in order to get financial independence and retire early. If you haven’t yet, please use the free subscribe button to always stay up-to-date!

As I started investing in stocks when I was 12 (currently I am 44), I already experienced a couple stock market crises and have made all the rookie mistakes. For me rule number one of Warren Buffett is very important: Don’t lose (money).

I analyze and invest in companies where I expect future growth or where I see a huge undervaluation ideally in combination with high dividend or share buybacks. This way I expect to compound and fire.

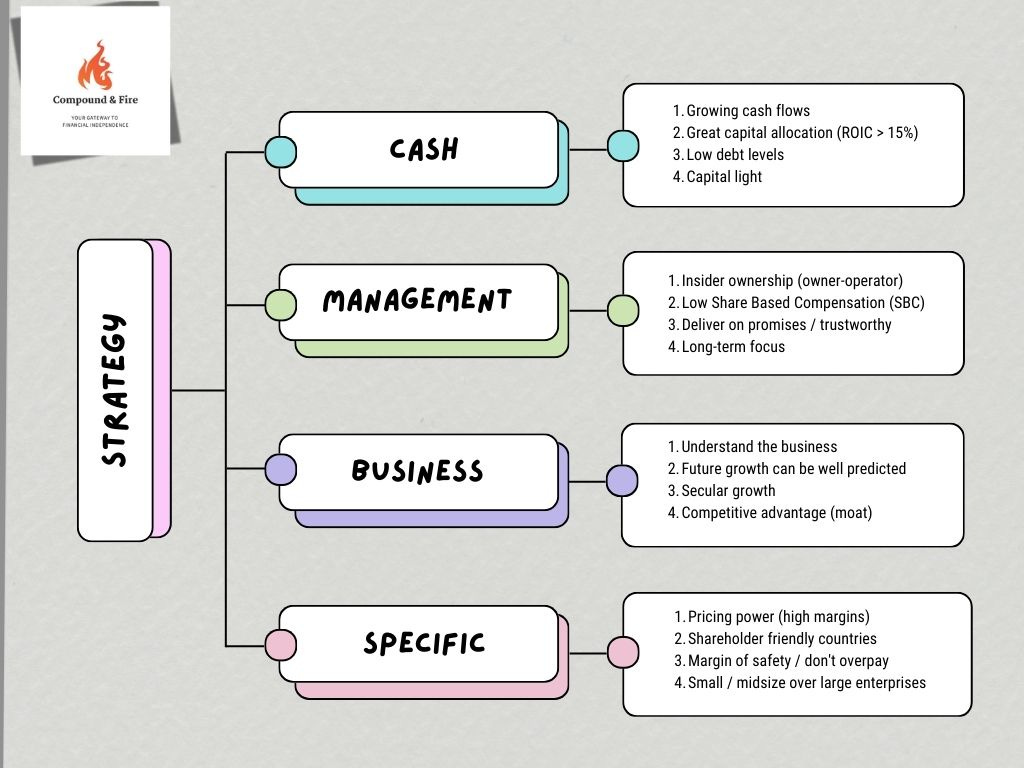

I follow a couple of principles:

Businesses is headquartered in a shareholder friendly country

A trustworthy management

I have to understand the business

They have a long-term focus and are great in capital allocation (ROIC)

Company is growing free cash flow

Future growth can be well predicted

The business ideally has a moat (helps in predicting future earnings) and / or pricing power

They can benefit from secular growth

Company has a healthy balance sheet

I buy when stock price shows a safety margin versus calculated value (DCF method)

Stay invested for the long-term

A lot of investors like to use screeners and add predetermined variables to this screener to reduce their investment universe. Although I agree this gives excellent companies based on historical earnings, most of these companies will already trade against a premium and a miss in future earnings can have a huge impact. Because of rule number 1: don’t lose money, I don’t want to limit my investment universe.

As my analysis time is limited, I like to watch and analyze businesses of great investors like (of course) Warren Buffett, but also names like Terry Smith and Stanley Druckenmiller.

My portfolio will mainly be focused around a couple of names. By doing thorough analysis I expect to reduce my risk to lose. Over the weekend I will share my portfolio, stay tuned!

Disclaimer

The information in this article is provided for informational and educational purposes only.

The information is not intended to be and does not constitute financial advice or any other advice, is general in nature, and is not specific to you. Before using this article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

None of the information in this article is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The author is not responsible for any investment decision made by you. You are responsible for your own investment research and investment decisions.