Kelly Partners Group: The Ultimate Quality Compounding Machine

In quality compounding we are looking for businesses that are able to reinvest their annual cash flows against high returns over a long period. Kelly Partners Group appears to be such a business.

Welcome to Compound & Fire! We search for businesses which create strong shareholder value over time in order to get financial independence and retire early. Join for free if you haven’t subscribed yet.

This article is a follow-up on my Serial Acquirers article where I had Kelly Partners Group identified as most interesting out of six companies. Please continue reading for a deep-dive on Kelly Partners Group.

The business

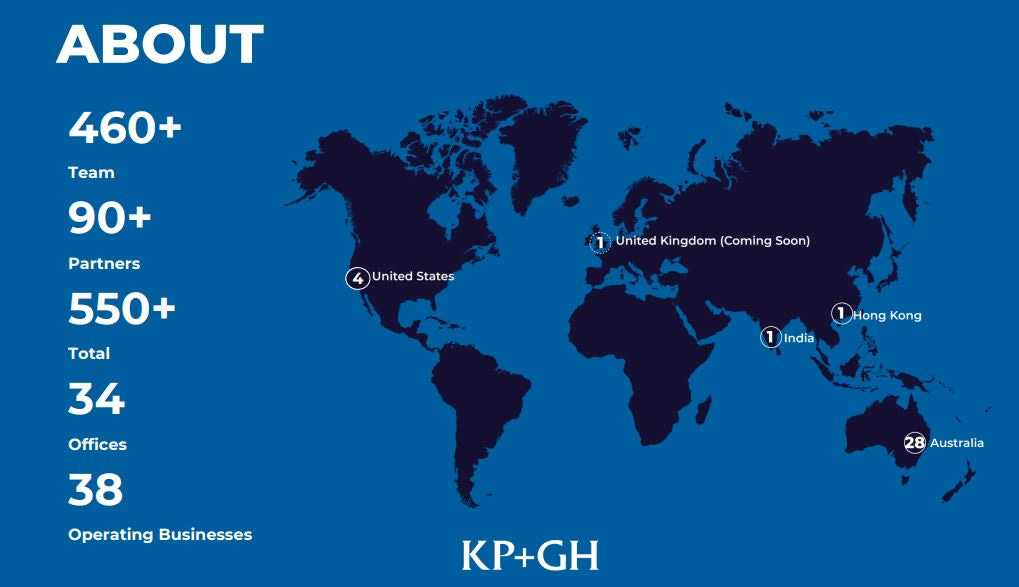

Kelly Partners Group (KPG) operates a network of chartered accounting firms across Australia and recently also the US. Their core services include accounting, taxation, auditing, corporate secretarial work, and wealth management advisory. The company focuses on serving small and medium enterprises (SMEs), private business owners and wealthy individuals.

KPG follows a unique "Partner-Owner-Driver" model. Each of their accounting firms is owned and operated by partners who have an equity stake in that specific firm. This ownership structure aligns the interests of the partners with their clients, as the partners' success is directly tied to their clients' success.

Source: KPG Owners Manual

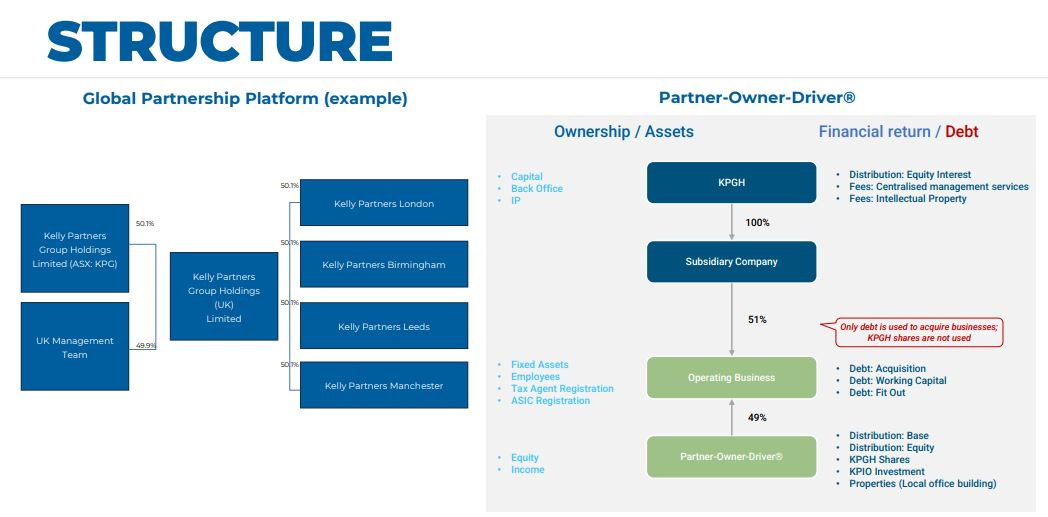

The above picture shows there can be two different setups. First the Global Partnership Platform, where KPG owns 50.1% of the UK Holding and a UK Management team owns the other 49.9% The Partner-Owner-Driver model shows . Within the UK Holding there are Operating companies where the UK Holding owns a majority (50.1%) in the Operating companies and the OpCo owns the remainder. Those OpCos can be greenfield businesses or acquired businesses.

Secondly there is the Partner-Owner-Driver model where KPG Holding creates a subsidiary and their subsidiary owns 51% of the acquired company and the partner-owner will own 49%. As shown, KPG Holding will not use equity to acquire new companies. They will always use debt, where the debt is put in the Operating Business and the acquired company will repay the debt in 4 or 5 years. They can do this, as KPG has a strict valuation model and will always pay maximum of 4 or 5 times earnings. Also they will split the pay-out with 1/3 in the first year and 2/3 after two years. From a cashflow perspective this is obvious very interesting, instead of paying the total amount right away.

KPG promises the acquired business to almost double their income. They can promise this as the acquired companies are relatively small, with around $1-2M revenue on average. This means SG&A as part of the revenue is quite high. As KPG is centralizing these SG&A costs, per company it will become a lot cheaper. On the other hand KPG expect to grow these businesses organically by increasing the services offered (diversification) and using the KPG marketing machine and customer apps.

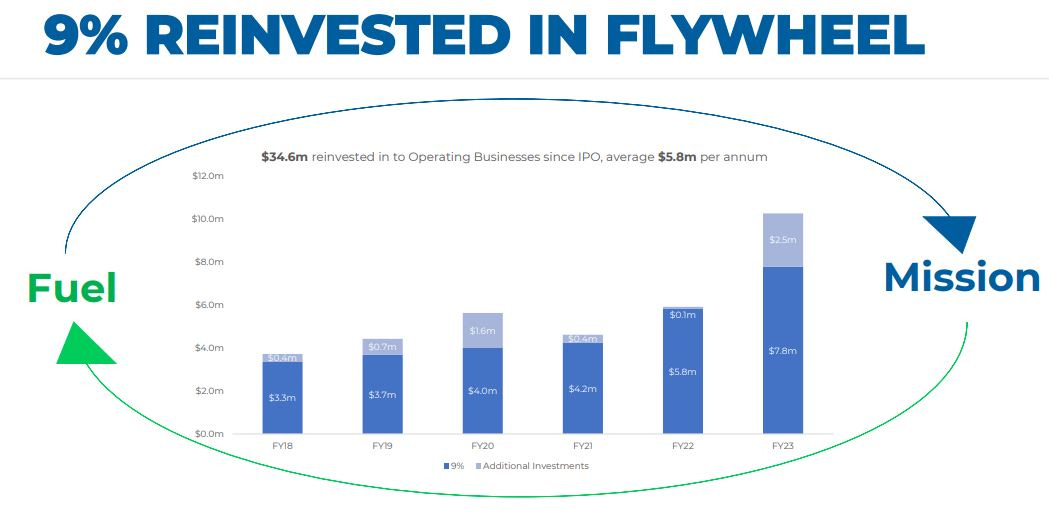

I often hear: why would companies become part of KPG if they have to pay 9% of their revenue and sell a majority stake in their business. What KPG offers these companies is selling just above 50% of their business, but keeping the same earnings as they double the profits. Also these companies don’t have to worry anymore on HR, IT, Marketing, Trainings etc. as KPG acts as a parent company providing shared resources, systems and support to the partner-owned firms. This model allows them to combine the personalized service of a local and decentralized accounting firm with the resources and expertise of a larger organization. For small companies this is a huge relief, and they pay 9% of their revenue to KPG, which is a Services Fee and an IP license fee. KPG doesn’t make any profits on this 9% and deliberately invests all the money into the business, being the fuel to succeed in their mission: We exist to help our People, Private Business Owners and the Communities we work in. Be Better Off.

Source: KPG Owners Manual

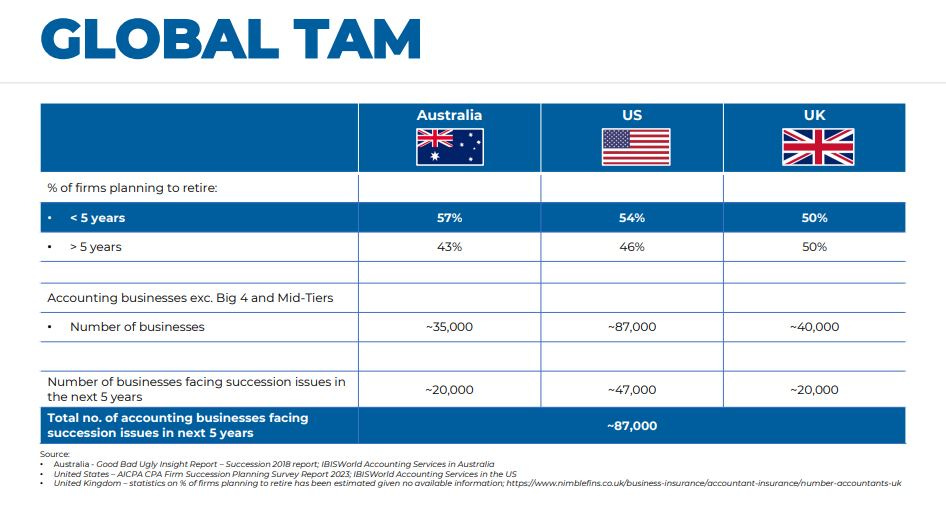

Finally, a lot of companies are looking for a successor. KPG also promises to find succession, but offers current shareholders of the acquired businesses to stay longer, potentially reduce their hours a bit, but remain partner for the next ten years.

When we look at the companies in Australia, US and UK which are facing succession issues in the next five years, we are talking about 87.000 companies in these three countries only. This is a large addressable market for KPG and gives them the opportunity to keep on growing the next 25 years.

Source: KPG Owners Manual

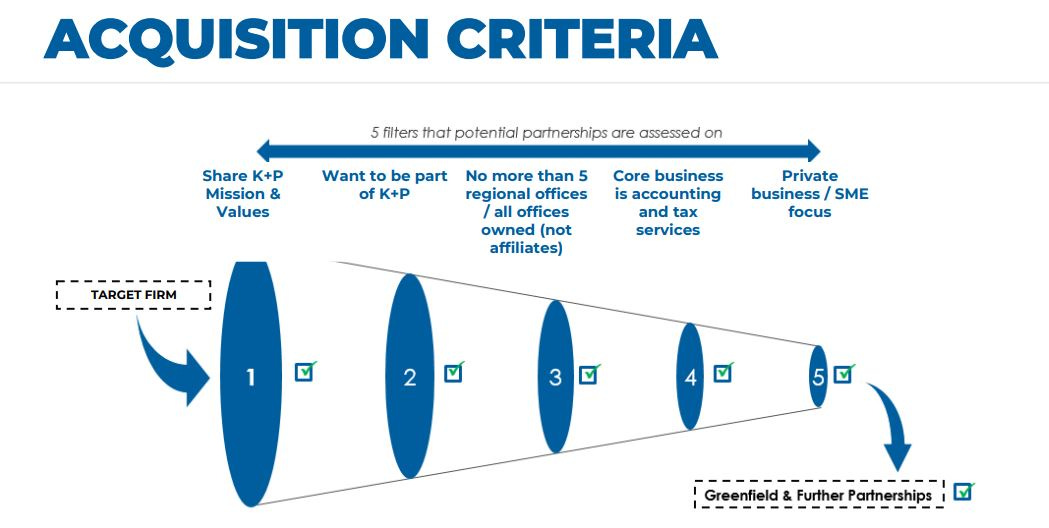

Kelly Partners Group has been actively acquiring accounting firms across Australia to expand its national footprint. Their long-term strategy involves expanding into other English-speaking markets, particularly the United States and the United Kingdom, where they see significant growth opportunities. Recently they have acquired a couple accounting firms in California (Los Angeles) and just announced a greenfield business in Texas, which will become a Partnership Platform, where a Texas Management Team owns a minority of the Texas business and will start the business from zero. Also Kudos International will become part of Kelly as per June this year. Kudos has member firms operating in multiple countries like UAE, Saudi Arabia, Indonesia, Malaysia, Argentina, Paraguay, and Peru and they have their headquarters in the UK. The opportunity with Kudos, next to a share in the membership fees, lies in developing relationships with the member firms and over time have the opportunity to partner with these businesses. Although there is a huge list with potential business acquisition candidates, KPG is very selective. Selective on the quality of the people, whether they have a similar mindset or not. And selective on price. Below their acquisition criteria.

Source: KPG Owners Manual

Their focus is really on Small and midsize companies, as their logic is that governments give larger companies tax benefits and SMEs and citizens has to pay more taxes. This has been the trend last years. Within Europe there are talks about a minimum tax for any company all over Europe, so from my perspective this might change in Europe coming years.

The current economic situation with high interest rates is much tougher for SME’s. KPG sees this as a significant opportunity as SME companies will become more reliant on their accountants to ensure they are financially sound. On the other hand if more and more SMEs would fall into bankruptcies this could become a risk.

Founder & CEO - Brett Kelly

For me the CEO is always very important, as he is responsible for the strategy and capital allocation of the company. Brett Kelly is the founder and CEO of Kelly Partners Group. He has over 25 years of experience in commercial and professional accounting, specializing in assisting private businesses, business owners, and families. He holds a Bachelor of Business from the University of Technology Sydney and a Master of Taxation from the University of New South Wales.

In 2006, Brett founded Kelly+Partners Chartered Accountants, which grew into the Kelly Partners Group network of accounting firms. In 2017 he took Kelly Partners Group public by listing it on the Australian Securities Exchange (ASX) and since this year they are also listed on the OTC Markets in the US. Under his leadership, Kelly Partners Group has expanded to 38 operating businesses across 34 locations, with over 550 employees serving over 23,000 clients.

Source: KPG Owners Manual

Brett explores some other activities too:

Brett is the host of the "Be Better Off Show" podcast, which features successful entrepreneurs and business leaders.

He is a business coach through the "Grow Program", aimed at helping businesses grow and increase value.

He is a professional speaker and has presented to over 1,000 audiences on various topics.

He is a best-selling author of four books focused on wisdom, business, and investing.

Brett is high energy and has a clear goal and focus. The purpose of his Be Better Off Show is to become healthier, wealthier and wiser. I truly believe that it is his own goal as well. All the additional activities of Brett have the purpose to grow individually and to learn and become better. Or how he calls it: compounding on the input. Compounding of wisdom by reading books, speaking to interesting people and continuous learning. Also his network increases and it’s not bad for his branding either.

Brett Kelly has said he want to stay for another 25 years and grow KPG further. He currently owns just below 50% (~48%) of the shares and has announced he will decrease his stake towards 35%. This because the cease of dividends reduces his cashflows by around 60%. Also KPG wants to be listed in the US and they want to increase the free float. With the US listing Brett will sell a stake in the company. He doesn’t want to increase the number of outstanding shares of 45M, as he argues: “If you would bring Picasso back to life and he would paint another 1.000 painting, then the price of his paintings is likely to drop”.

Growth story

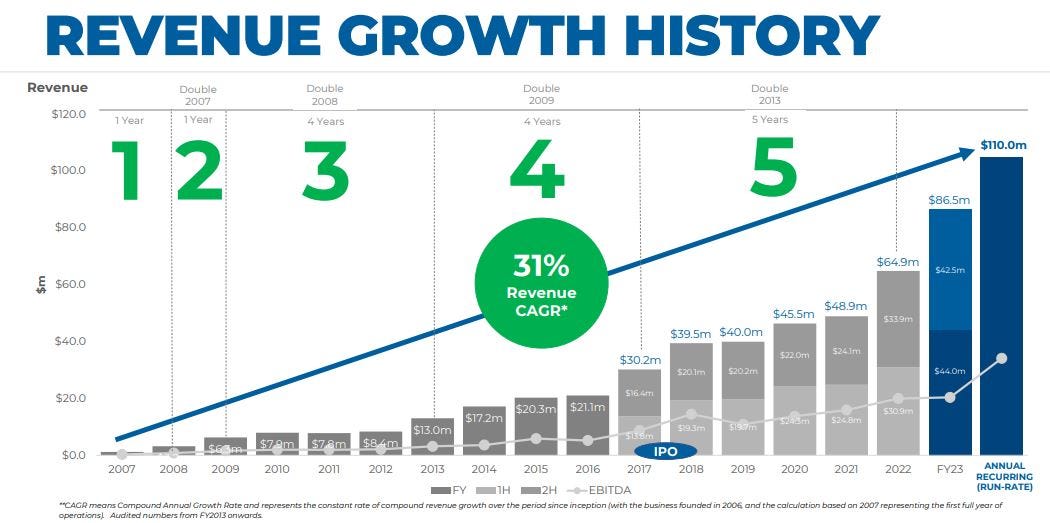

All the acquisitions combined with organic growth resulted in the company growing at a CAGR of 31% since 2007. They have doubled their business multiple times, where the last time it took 5 years and it looks like it will now only takes a bit more than 2 years to double. Their target is to double their business every three years for the foreseeable future.

Source: KPG Owners Manual

Can KPG continue this growth story? I think they can, they just started with revenue expected at A$110M FY24. They will just continue acquiring small accountancy firms in a defensive and fragmented sector. They won’t change the size of the deals, they will stick to these small acquisitions, but they will acquire more of them. To give an indication, last year Kelly acquired 9 companies and since they are listed to the ASX they closed 35 deals.

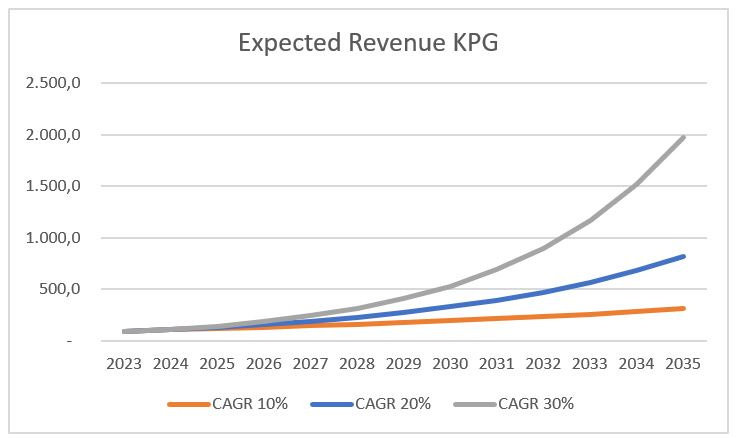

Now let’s have a look at how revenue would look like, assuming FY 2024 ends at A$110M and assuming three options: a CAGR of 10%, 20% and 30%. Here you also clearly see the impact of compounding. A 10% CAGR would give a revenue of A$ 314M in 2035, where 20% would give A$ 817M and 30% would end up with A$ 1,971M in 2035. This is why it is so important to find businesses that focus on compounding and which put the shareholders first.

Gross margins

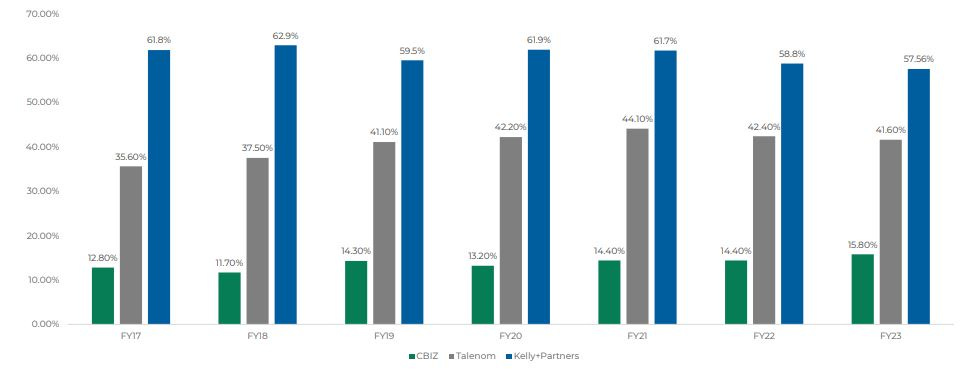

“High gross margins are the most important single factor of long run performance. The resilience of gross margins pegs companies to a level of performance”- Matthew Berry, “Mean Reversion in Corporate Returns” (source: 100-Baggers – Christopher Mayer)

Source: KPG Owners Manual

Based on above graph it’s clear that KPG has much higher gross margins compared to their competitors. In full years 2022 and 2023 the gross margins are dropping, but this is impacted by recent acquisitions, which volume wise were high in both years. So close to 60% should be good for KPG which, according to Matthew Berry, is an important factor for long run performance.

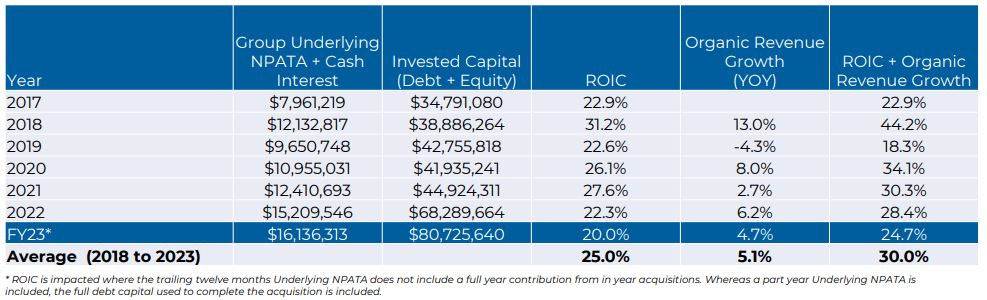

NPATA and Return on Invested Capital

NPATA is the Net Profit After Tax Before Amortization and the Underlying NPATA is a key measurement used by management to assess and review business performance. It takes the net income and adds back the amortization of customer related intangibles to get to NPATA. From NPATA to get to Underlying NPATA it adds back acquisition related costs and other non-recurring items and deducts the non-recurring revenue like government grants and changes in fair value of contingent consideration. The underlying NPATA shows the net income if KPG wouldn’t have any acquisitions and one-off costs / non-recurring revenues.

Source: KPG Owners Manual

The average ROIC over the past 5 years was 25%, which is very interesting. KPG, like Constellation Software who is using the same metric, adds the organic growth to get to a number which shows the return on the invested capital plus the organic growth, which on average has been 30%.

As KPG has plenty of opportunities to continue their growth, especially in Australia and US, I expect we will see similar return on investments the coming years.

Balance sheet

Most important towards the balance sheet, given KPG is a serial acquirer, is the level of goodwill and the debt ratio. Looking at the latest annual report (June 2023) goodwill balance was 41.2M versus an equity of 35.5M Goodwill arises on the acquisition of a business and KPG doesn’t amortize, but instead tests the goodwill balance annually for impairment, or more frequently if situation requires to do so. This means that if acquisitions don’t contribute as expected, there is a risk of an impairment. Because KPG acquires a lot of small companies, the goodwill balance is distributed over multiple acquired companies, which reduces the risk. In general I prefer goodwill balance to be lower than the equity, but given the fact KPG is a serial acquirer and will acquire multiple companies a year the next few years and is paying around 4 to 5 times earnings, this will automatically impact the goodwill. Note: KPG also pays for customer relationships and these will be amortized.

Then looking at the debt, the metric which KPG uses is the Gearing ratio, which is the Net debt divided by the Underlying EBITDA. At the end of 2023 this ratio was 1.65x. KPG wants to stay below 2.0x and according to the covenants with their bank it’s allowed to get to 2.5x maximum. So far KPG always has repaid the debt of acquisitions within 5 years.

The higher interest rates of the last year will slightly increase their payback periods, as the cost of funding the purchase is slightly higher than before. However important to note that KPG says the increased interest rates has not impeded their ability to fund acquisitions.

Constellation Software

Constellation Software is a company which is also a serial acquirer, but in a different market. Their strategy has been very successful and Brett Kelly has studied Constellation thoroughly. There a some comparisons:

Both are Serial acquirer and are holding companies where they own the majority of the shares in operating businesses.

Both incentivize management teams through equity ownership, which means the acquired company will keep ~49% of the shares. Very important for the alignment of interest.

Both are pursuing a global expansion strategy.

Both have a decentralized operating model.

Both focus on Return on invested capital + organic revenue growth.

Both have a deep expertise in their business and a very talented CEO.

Lawrence Cunningham is the vice chairman of Constellation and became Non-executive Independent director of KPG.

The difference is Constellation Software started earlier and was already stock listed in 2006. At that time Constellation had $210M in revenues (versus $8.4B last year!). KPG’s expected revenue in 2024 is AUD 110M, which is around $73M. So if we would compare, then Constellation Software would not even have been listed, just to indicate KPG is still very early stage if you believe in their potential growth story.

When I look at the CAGR in revenue for the 10 years for Constellation Software since 2003, it was 31%. Exactly the CAGR which Kelly Partners has shown the last years. Looking at the ROIC + organic net revenue growth the average in those ten years for Constellation was 31%, where the average for Kelly Partners is 29% for the last 7 years.

I also have verified the goodwill balance of Constellation software in their early years. Their goodwill balance always has been lower than their equity. That is a difference versus KPG. Another difference is Constellation Software was paying a dividend from 2006 onwards (CAD 0.20) and from 2008 till today 4.00 CAD. This 4.00 CAD is around 85M CAD Constellation couldn’t invest in their business. KPG announced this year they will stop paying a dividend and will allocate the capital to further grow their business.

Risks

The main risk to me is something would happen to the founder Brett Kelly and he can’t exercise his role as CEO anymore. Although they have a succession plan ready, he breaths the culture, he has compounded knowledge on serial acquirers and on accounting over the last 30 years and I don’t see someone replacing him in the same way.

Interest rate risk: the group is exposed as they have borrowed money at fixed and floating rates. As mentioned before an increase in interest rates will increase the payback period slightly, but obvious it will also impact net income. A further increase in interest rates cost them ~0.4M AUD but rates can also trend the other direction.

KPG always has to find new partners which they can acquire. As they are very selective it might take time to get to the volume they need and volume will have to increase over time. In order to meet targets KPG could become less focused on the quality of the businesses they acquire (although Kelly says he won’t compromise on this).

KPG is expanding into new markets like US and UK. These are new countries and there always comes a risk to an unknown market. I think it’s very strong Kelly moved to the US himself to setup the business there. It is probably even key to do so, like Mike Cannon-Brooks did when he was building Atlassian.

Liquidity risk: acquiring all these companies comes with debt. There is a risk the company will encounter difficulty in meeting its financial obligations. Of course they will have policies in place to avoid such a situation.

If taxes would become more simple, e.g. a flat tax rate, then there is a risk with rapid changes in technology that SME’s become less dependable on KPG. So far the opposite is true and taxes only has become more difficult.

Valuation

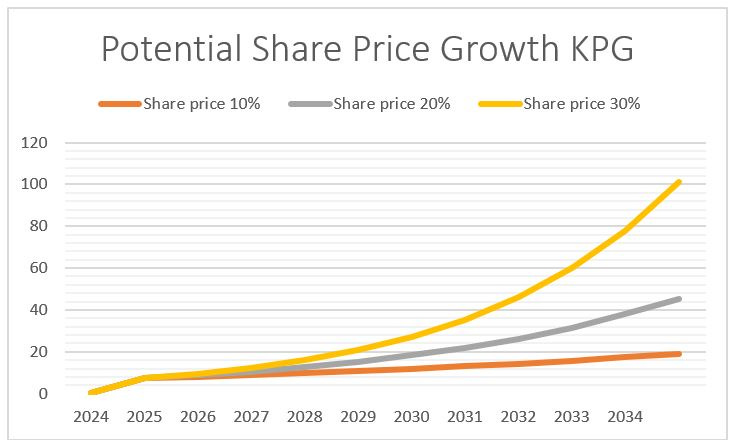

For the valuation I will work with three different options: revenue CAGR coming years of 10%, 20% and 30%. The EBIT margin I expect to come in around 25%, the terminal growth rate at 5% (I actually expect Kelly to grow faster, as they target to continue growth for the next 25 years) and the WACC at 10.0%. The outcome for the three scenarios:

10% revenue growth – equity value of 270M and an intrinsic value of 6.0 AUD

20% revenue growth – equity value of 534.2M and a intrinsic value of 11.88 AUD

30% revenue growth – equity value of 1,031.4M and a intrinsic value of 22.94 AUD

It is important to mention that the outstanding number of shares is 45M and KPG is not planning to increase the number of outstanding shares. Only when share price would be close to intrinsic value, it might become interesting for shareholders to raise equity. But only if the returns are high enough for current shareholders. The company doesn’t use any share based compensation which would result in a dilution of shares. Share based compensation to Kelly is unfair, as it only gives management upside and the downside would only be felt by shareholders.

At a current share price of 7.42 AUD this means the most conservative scenario with 10% revenue growth would not fit the current share price and we would be overpaying, however I am sure KPG will get to 20% a year. If I expect KPG to grow the next years by 20% a year, that would give an upside to the current share price. If I would consider a margin of safety of 30% versus an intrinsic value of 11.88 AUD this means the buy-below price of KPG is 8.32 AUD.

Currently we are paying close to 3 times sales for 2024, assuming 110M AUD in sales for the current year. As we know the outstanding shares is likely to remain at 45M shares, we could calculate the share price if we would keep this ratio at 3 times sales (Constellation is currently trading at 8x sales, although I think this is at the high end). In my graph I will show the outcome for the 3 scenarios again with a 10%, 20% and 30% growth in revenue.

In those ten years we probably will see years with stock market declines, but if KPG will continue their growth story, then the underlying business will grow and stock price will follow. When you look at Constellation Software then you can see since 2006 there has been no year the stock price was lower at the end of the year versus the begin of the year. Even in 2008 with the financial crisis Constellation Software still went up over a year (start 2008 CAD 23.25 and end of 2008 at CAD 25.25). This is because the underlying business kept on growing. If KPG can accomplish their strategy and expand their business by growing 20% revenue in a year, it would mean you will see your capital sixfold in ten years.

Reason for me to have add Kelly Partners Group to my portfolio last month at 7.40 AUD and make it one of my businesses where I have the highest conviction. Brett Kelly wants to become the Berkshire Hathaway of accounting. He is on the right path. You could become a partner too, but a gentle reminder: there are only 45M shares available of which Brett Kelly will keep 15.75M. And Kelly is probably not going to “paint” any new shares.

Hopefully you have enjoyed this update of my portfolio. Feel free to like the post and share it with friends!

Disclaimer

The information in this article is provided for informational and educational purposes only.

The information is not intended to be and does not constitute financial advice or any other advice, is general in nature, and is not specific to you. Before using this article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

None of the information in this article is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The author is not responsible for any investment decision made by you. You are responsible for your own investment research and investment decisions.

Great article & introduction to KPG, thank you! This leads to me wanting to research more about the business.

Iirc, the debt is at the operating business non-re course to parent kpg. Should alleviate the risk a little bit. Worth mentioning in the article.