Wanted: Serial Acquirer!

The suspect we are looking for is a serial acquirer. Nation of origin: unknown. Age: Young (early-phase), Height: Maximum of $150M revenue. I think I have found our suspect, so let's lock it in!

Photo: Image by DGIM-Studio

Welcome to Compound & Fire! We search for businesses which create strong shareholder value over time in order to get financial independence and retire early. Join for free if you haven’t subscribed yet.

Serial Acquirers - background

Compound & Fire is not complete without an article on Serial Acquirers, which often are very strong compounders. The best entry point to invest in a serial acquirer is at an early stage, as you might run into a 100-bagger, the dream of every investor! However, we should never forget rule number 1: don’t loose.

In this blog I will discuss which characteristics a serial acquirer should have to become a potential compounder and I will shortly discuss 6 early stage serial acquirers.

One of the most powerful wealth creation strategies in business is the ability to consistently reinvest capital at high rates of return, well above a companies weighted average cost of capital. This is the core principle behind successful serial acquirers: companies that regularly acquire other businesses and redeploy their cash flows into new acquisitions.

By redeploying strong and growing operating cash flows into accretive acquisitions year after year, serial acquirers can compound their capital at premium rates over long periods of time at relatively low risk.

The best operators develop repeatable processes and deep industry expertise that allows them to identify, acquire and improve undervalued companies.

The most successful examples like Danaher, Constellation Software and Roper Technologies have generated outstanding returns for shareholders by adhering to a disciplined acquisition strategy within their core verticals.

Just to give you an idea on one of the best compounders of all time, Constellation Software, here is the return since May 2006:

Source: Finchat

It is a 27.472% return (!). Who had invested $10k in Constellation in 2006, when their revenue was around $210M, would have reached more than $2.7M in 18 years. Even recognizing this compounder “late” in 2014 with a revenue just shy of $1.7B, would still have given you an enormous 1.746% return.

Good reason to understand these serial acquirer characteristics. The earlier mentioned characteristics discussed in this article:

redeployment of cash flows

growing operating cash flows

repeatable process and deep industry knowledge

disciplined acquisition strategy

and other characteristics inlcude:

Decentralized operating models allowing subsidiaries to run independently

Funding acquisitions from internal cash flows rather than debt

Significant insider ownership and alignment of incentives

Consistent organic growth in addition to acquisitive growth

Low growth in share count

While the strategy seems simple in theory, building a true acquisition machine with robust processes for sourcing, evaluating, integrating and operating acquired subsidiaries is incredibly difficult. Those that get it right can achieve a powerful compounding effect on both earnings and intrinsic value over many years.

The allure is the tendency for high-quality serial acquirers to reinvest most or all of their free cash flows for decades at high rates of return on incremental capital. This, combined with the diversification benefits of operating across multiple verticals, makes it easier to let these companies compound almost indefinitely.

So while they may not receive the same hype as disruptive tech companies, the best serial acquirers can generate outstanding returns by leveraging their acquisition skills, scale and cost of capital advantages in a cycle of disciplined capital redeployment. Acquiring companies against 4 or 5 times EBIT or EBITDA (depending on the level of capex), improving them and having their own company listed against a much higher multiple automatically means value addition to shareholders. As shown earlier with Constellation Software. And the earlier you are a shareholder of such a company, the more you can benefit from the compounding impact.

That’s why I think it is very interesting to go over a couple early stage serial acquirers in this post. Early stage because all companies still have a revenue below $150M per year.

I will share six early-stage serial acquirers with a short description for each and will (high-level) review which serial acquirer would match by criteria and might has the potential to keep on compounding for the next 20 years.

1. ADDvise

ADDvise Group is a Swedish company that operates as a serial acquirer in the life sciences sector. It focuses on acquiring and integrating companies that supply equipment, fittings, and solutions to healthcare facilities, laboratories, and research institutions.

The company has a clear strategy of growth through acquisitions, both geographically by expanding into new markets, and by diversifying its product portfolio within the life sciences industry. ADDvise aims to create value by identifying and acquiring undervalued companies, integrating them into the group, and leveraging synergies and economies of scale.

While the individual acquired companies continue to operate relatively independently, ADDvise provides a decentralized management structure and shared resources to drive operational improvements and growth across the group. The company reinvests its cash flows from operations into funding new acquisitions, maintaining a disciplined approach to capital allocation and avoiding excessive debt.

2. Judges Scientific

Judges Scientific is a UK-based company that acquires and develops businesses operating in the scientific instrument sector. Its core activities include the design, manufacture and sale of scientific instruments across various markets like higher education, scientific research, manufacturing and regulatory bodies.

The company operates through two main segments: Materials Sciences and Vacuum. It has a portfolio of subsidiaries, primarily based in the UK, that produce instruments for applications such as plasma surface treatment, cryogenics, fiber optics, and materials testing. Some of its notable subsidiaries include Armfield, CoolLED, Deben, Dia-Stron, and Quorum Technologies.

Judges Scientific follows a serial acquisition strategy, regularly acquiring and integrating companies in the scientific instrumentation space to drive growth. With over 500 employees and revenues exceeding £128 million, it has established itself as a prominent player in its niche market through disciplined acquisitions and a decentralized operating model that allows acquired companies to run independently.

3. Kelly Partners Group

Kelly Partners Group Holdings is an Australian accounting and professional services firm that operates through a unique "Partner-Owner-Driver" model.

The company has grown rapidly since its founding in 2006 by acquiring and partnering with independent accounting firms across Australia, Hong Kong, the United States, and India. Rather than fully acquiring these firms, Kelly Partners brings them into their network while allowing the existing partners to retain an ownership stake and operational control. Often it is a 51/49 share, where Kelly Partners takes the 51% so they have the control and are able to consolidate the company in their earnings.

This decentralized model aims to align incentives and leverage the entrepreneurial drive of the local partners. Kelly Partners provides shared resources, systems, and branding while the partner firms continue operating semi-autonomously.

The core services offered include accounting, tax, corporate secretarial, CFO advisory, auditing, bookkeeping and business structuring - primarily for private businesses, SMEs and high net worth individuals. Some wealth management and broking services are also provided.

Through this acquisition-driven growth strategy, Kelly Partners has expanded to over 30 locations across multiple countries with over 550 staff and 92 operating partners serving around 15,000 client groups and has an NPS (Net Promotor Score) of +70, which is very high in their industry.

4. CHAPTERS Group AG

CHAPTERS GROUP AG is a publicly traded holding company that invests in and acquires small- and mid-sized enterprises primarily in the vertical market software (VMS) space in Europe. Their strategy is focused on pursuing a long-term and entrepreneurial investment approach, providing permanent capital to enable the growth and development of their portfolio companies. Their origins date back to a software startup founded in 1998, which they later sold in 2018 to transform into a holding company.

A couple key points about CHAPTERS GROUP AG's business:

Invest in and acquire mission-critical businesses across Europe, building a decentralized group of companies.

Look for outstanding entrepreneurial management talent to lead their portfolio companies and enable them to thrive and grow.

Have over 30 operating companies in the group across multiple platforms and sectors.

Have a base of long-term oriented investors providing the permanent capital needed to fuel their growth strategy.

In addition to their core VMS focus, CHAPTERS Group holds a significant minority stake (around 29.9%) in Fintiba GmbH, a leading FinTech company specializing in blocked accounts for foreign students. This stake provides potential upside and diversification.

CHAPTERS Group's unique combination of a focused VMS investment strategy, decentralized operating model, long-term horizon, serial acquisition approach, and the Fintiba stake sets them apart from traditional private equity firms and other holding companies.

5. Software Circle

Software Circle is a UK-based company that acquires and provides a permanent home for vertical market software (VMS) businesses. Their strategy is to be a serial acquirer, helping founders find the right exit strategy without fuss or drama.

They aim to acquire software businesses that meet the following criteria:

High profit margins.

Operating in a niche vertical market.

At least £500k in recurring revenues.

Positive company culture with good people.

Historically profitable with stable or growing EBITDA over the last 3 years.

Based in the UK or Ireland.

Software Circle's approach involves:

Being transparent about valuations without inflated initial offers.

Making the acquisition process smooth.

Allowing acquired businesses to continue operating independently, while providing support where needed to protect the entrepreneurial spirit and culture.

Their goal is to continue the operations of acquired businesses in a decentralized way, keeping the existing teams, management, and culture intact while providing a permanent home for growth. Software Circle has acquired businesses across various sectors like graphics, e-commerce, finance, property management, and care management software.

Software Circle (formerly known as Grafenia plc) underwent a significant transformation recently, including a rebranding and change in strategic direction.

CHAPTERS Group owns a minority stake in Software Circle since 2023 and as of early 2024 owns 29.9% of the business. Software Circle aligns well with CHAPTERS Group's investment focus on vertical market software companies and their strategy of acquiring majority stakes in niche software businesses.

Important note: Software Circle announced a post balance sheet event concerning a matter with PFI Group :

“On 1 June 2023 Grafenia plc announced that a £514,223 instalment of deferred consideration from Rymack Sign Solutions Limited, a privately owned company trading as PFI Group (“PFI”), due on 31 May 2023 was not made. The Company remains in discussions with PFI to resolve the matter. The total outstanding consideration is £2,809,973. The carrying value in the financial statements is £1,698,000.”

Source: Software Circle Annual Report 2023

6. SDI Group

SDI Group is a UK-based serial acquirer of niche manufacturing businesses. Their primary focus is on acquiring and building a portfolio of companies that design and manufacture various medical, industrial, and scientific equipment and instruments.

SDI Group operates through a "buy and build" strategy, where they acquire small, niche businesses and then allow them to operate autonomously as separate entities under the SDI Group umbrella. After acquiring a company, SDI introduces stronger financial controls, consolidates operational reporting and budgeting at the head office level, and facilitates cross-sharing of information and synergies between the different business units.

The key aspects of SDI Group's acquisition strategy are:

Due Diligence: The CEO, Mike Creedon, personally conducts due diligence for each acquisition, sometimes with support from internal resources.

Financing Acquisitions: Initially, SDI raised equity for acquisitions, but later used cash flows and debt capacity for most acquisitions. They have not raised outside equity since February 2019.

Post-Acquisition Operations: Acquired businesses operate autonomously, with around 70% of founders staying on in some capacity. The head office monitors operations at the business level and facilitates synergies between units.

Acquisition Criteria: SDI targets niche manufacturing businesses, often acquiring them at 4-5x EBIT multiples, with the aim of achieving 5-10% organic growth and realizing synergies post-acquisition.

Through this "buy and build" strategy, SDI has grown its revenue from £4.0 million in FY2014 to £67.6 million in FY2023, acquiring successfully 16 companies. Recently the share price has fallen as SDI Group booked an impairment of GBP 3.5M and there is a new management team in place.

High-level review

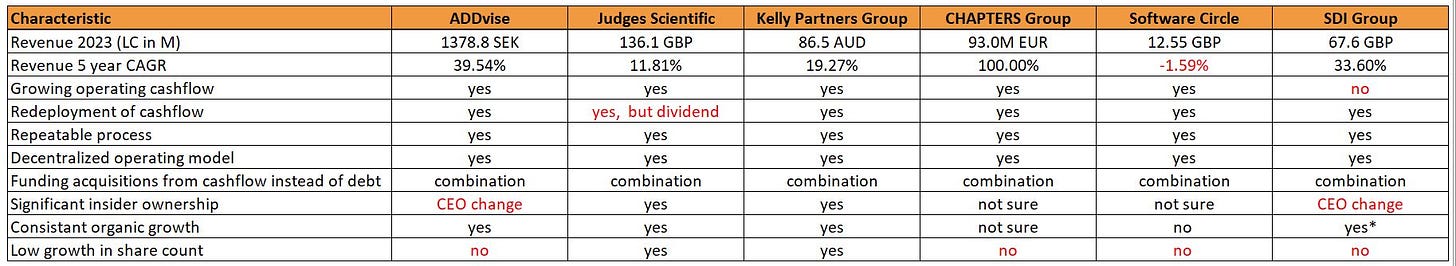

To determine which company out of these six I like most, I have conducted a high-level review and put it in a table:

Rule number 1 for me is “Don’t loose”. Especially with such companies it is important:

They don’t raise capital to acquire new companies, as this results in dilution for shareholders.

The management is very reliable and expected to remain within the company for a long, long time.

That is the reason why ADDvise, CHAPTERS Group, Software Cirlce and SDI Group are not an option for me. It doesn’t mean you can’t get a good result with these companies, you might even get a higher result, but the risk is also higher. I just don’t want to loose. Also,Software Circle just went to a transformation and SDI Group just installed a new management team. I prefer to have a proven track record for the company as a whole or the CEO (management team) as the leader of the company.

This means we have two companies remaining, which I both like: Judges Scientific and Kelly Partners Group. My serial acquirer pick is Kelly Partners Group for the following reasons:

Judges Scientific has performed great, but their CEO is 75 years old. Maybe he is the new Warren Buffett and will stay a lot longer, but there is a risk he has to be replaced. Brett Kelly, the CEO of Kelly Partners Group, is close to 50 years old and has said he want to stay for another 25 years to grow his business.

Judges Scientific is paying a dividend, while Kelly Partners Group just announced they will stop paying a dividend. Owning a serial acquirer, which can invest the cash against very attractive returns, I prefer the company to use the cash for acquisitions, instead of dividend.

Brett Kelly’s number one rule is Don’t loose. I think both CEOs know their markets very well, but Brett read so much about compounding, about Warren Buffett and Bernard Arnault, about Constellation Software. I think his focus, experience and drive to compound the business are outstanding. He also won’t increase the number of outstanding shares.

Finally I expect the market in which Kelly Partners Group is active as more recession proof and they seems to grow faster versus Judges Scientific and Kelly Partners Group is even more early stage as they have a lower revenue.

For my portfolio I have bought Kelly Partners Group this morning at the Australian Stock Exchange for AUD 7.40. I am planning to share a deep dive of the company next month, but can already share my conservative valuation (DCF-method) which is AUD 11.50. I will update my portfolio on my Substack soon.

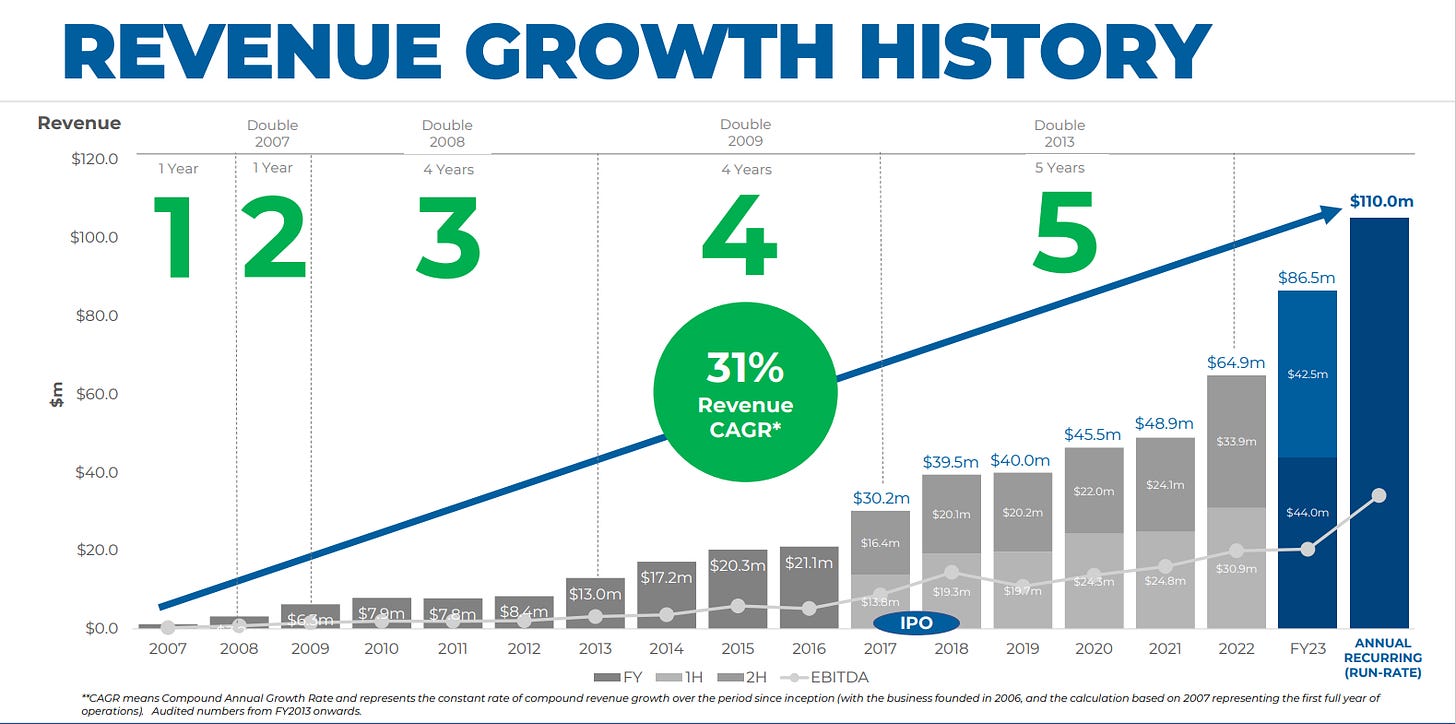

To conclude I will share a picture on the growth the last years, where you can see how long it took to double the business. Kelly Partners Group entered the United States, acquired Kudos International and will acquire more companies around the world using their partner / owner model. I expect below trend to be continued for the coming years. The picture is part of the Owners Manual on their website (link below the picture). It’s a great reading and I would highly recommend to read it.

Source: Kelly Partners Group Owners Manual

Give this post a thumbs up if you liked it! Or press the button to share it with friends.

Disclaimer

The information in this article is provided for informational and educational purposes only.

The information is not intended to be and does not constitute financial advice or any other advice, is general in nature, and is not specific to you. Before using this article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

None of the information in this article is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The author is not responsible for any investment decision made by you. You are responsible for your own investment research and investment decisions.

Nice post! I bought recently sdiptech and hg capital trust so miss them in your list ,own sdi and kpg and looking @ chapters!

unfortunately Kelly is not investable in my country at general brokers. Was watching it more than a year ago and also today, still not investable. very sad. but I own Judges.