ZIGExN: High Quality At A Crazy Discount

I have bought ZIGExN for the Compound & Fire portfolio as the stock market doesn't give the right value to it's growth potential with a discount of 150% to intrinsic value.

Welcome to Compound & Fire! We search for businesses which create strong shareholder value over time in order to get financial independence and retire early. Join for free if you haven’t subscribed yet.

ZIGExN - the company

ZIGExN is a Japanese serial acquirer with a current market cap of ~$390M. ZIGExN is specialized in acquiring niche online platforms and they integrate those new business into their life media platform business.

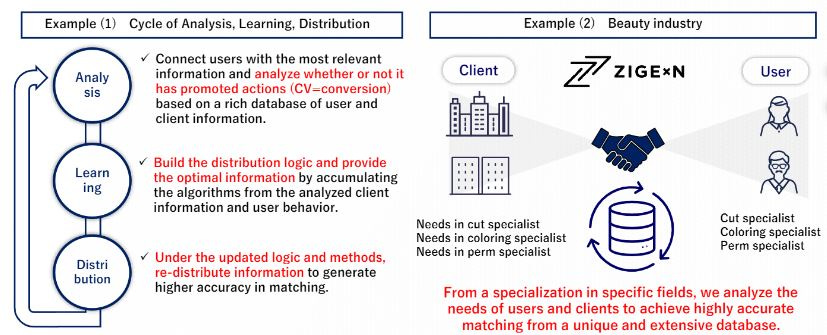

A matching technology has been developed which match users with customers in specific industries and regions. This might sound a bit vague. ZIGEnX recognizes that the internet gets flood with information and they want to filter out the right information for their customers. That is where their database and matching technology comes into play. It gives the ability to provide users with the most appropriate information and encourage them to take action. Here are two specific examples of their matching technology:

That database became bigger since ZIGEnX has acquired 28 companies. The core of this database is the same for all the fields they operate in. ZIGExN distinguishes itself from competitors through this integrated approach to information aggregation and its focus on specific industries and regions. By operating specialized platforms, they can provide more targeted and relevant services to both users and businesses in those sectors. CEO Joe Hirao wants to become the largest online company in Japan.

The company operates in three main fields within their Life Media Platform segment:

Human resources

Real estate

Living

ZIGExN develops, operates and maintains various websites and applications that cater to these fields. To give an overview of the main services by segment:

Source: ZIGExN new investor deck

Vertical HR Segment

ZIGExN runs job search / placement platforms by a certain industry. This means not one job search platform like e.g. Monster, but specialized ones. Their business model is on one hand job postings by corporate clients, who are paying for listings or for performance and on the other hand job placements and temporary staffing, where customers pay for performance or a staffing compensation.

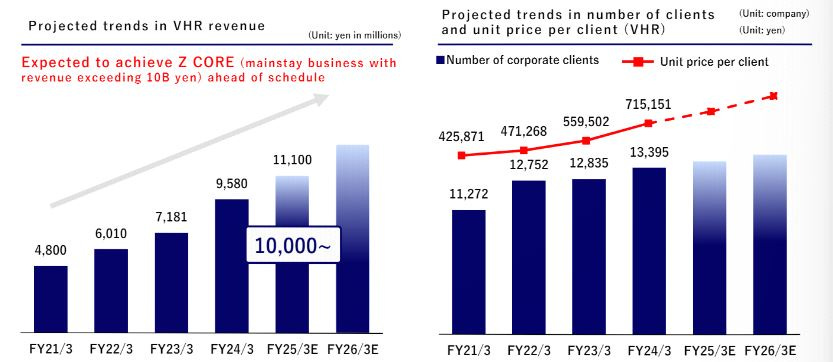

In Vertical HR ZIGExN is progressing towards a 10B plus revenue in 2026 and it looks like they will reach this ahead of schedule. with an increased number of corporate clients and especially an increase in unit price per client.

Source: ZIGExN new investor deck

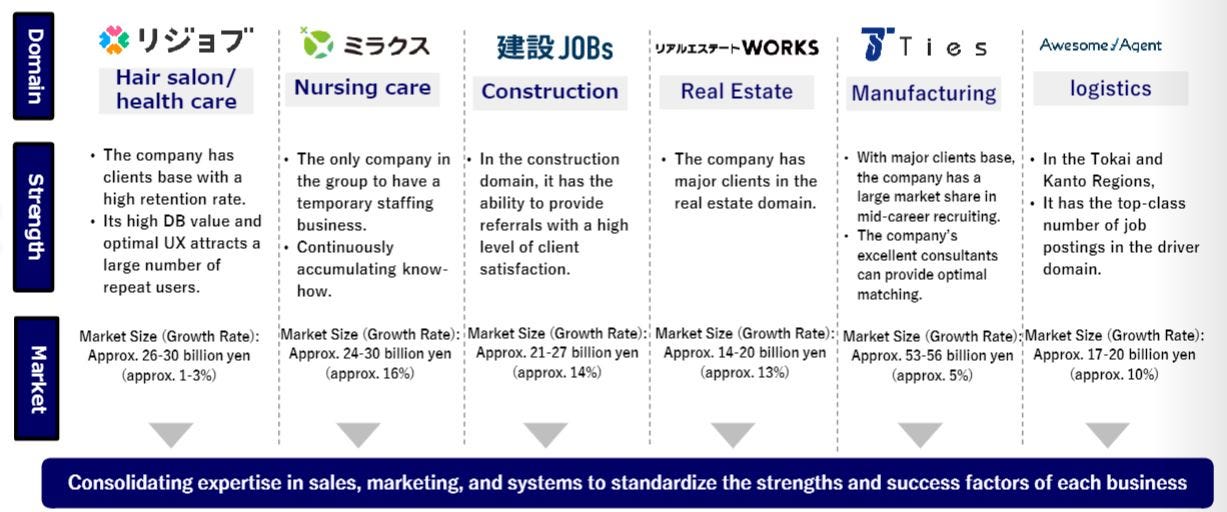

The business model is focused to job recruitment, job placement, temporary staffing and database scouting. They are active in some niche markets like Hair salon, Nursing care and Construction and there is a lot of space to growth in new target markets like Medical care, Food and Drink, Finance, IT, Retail and Medicine.

An overview of existing businesses in Vertical HR including their strengths and market sizes:

Source: ZIGExN new investor deck

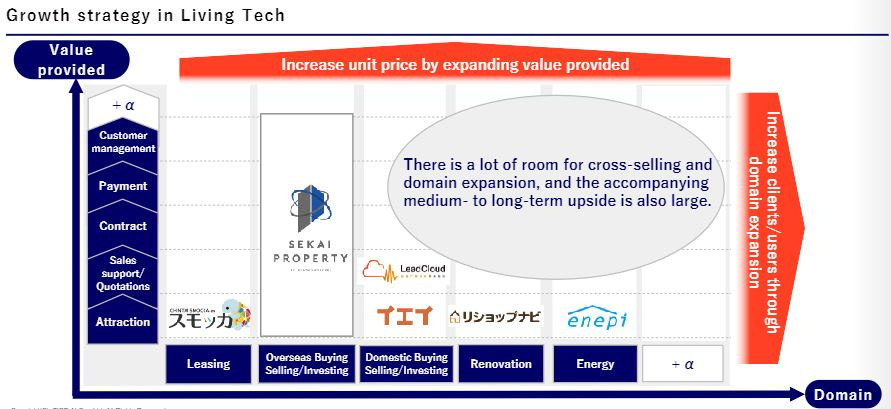

Living Tech Segment

This segment consists of:

an aggregation platform which allows users to search and apply for information from multiple websites at once. Customers include media clients, real estate companies and renovators.

real estate investment agent business, which introduces properties mainly in Southeast Asia to wealthy individuals in Japan. Customers are both developers and users.

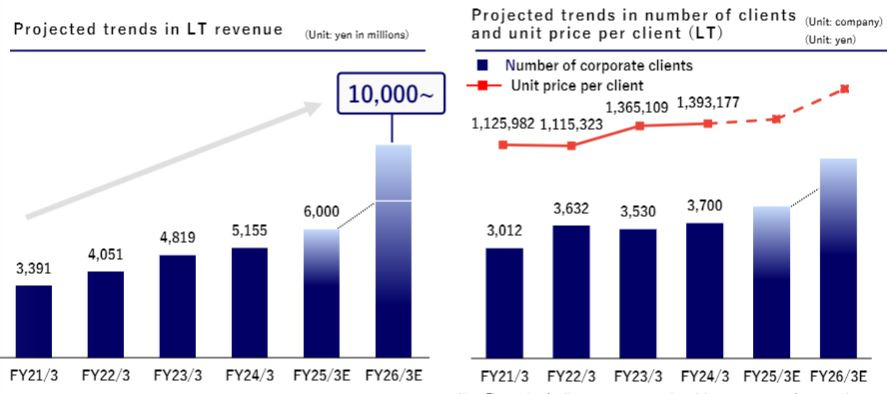

The goal for Living Tech was to achieve 10B yen in revenue, however this seems to be a challenge. ZIGExN however maintained the goal and still wants to accomplish this target through a combination of organic and inorganic growth.

Source: ZIGExN new investor deck

To accomplish the target of 10B yen there is a clear growth strategy in place, where the company aims for:

Increase value provided to customers and hence increase unit prices

cross selling and domain expansion

explore opportunities for expansion into higher value add business models

The picture below is showing their strategy:

Source: ZIGExN new investor deck

Life Service Segment

This segments has platforms related to automobile (used cars), travel (hotel bookings) and starting your own business (franchise search platform). Customers include hotel or airline ticket wholesalers, hotels and airlines, travel companies, media clients, credit card companies, other companies and users.

ZIGExN wants to grow this segment by also expand the product lineup and enhance the value provided.

Management - The CEO

Joe Hirao was born in 1982 in Tokyo and graduated from the Faculty of Environment & Information Studies at Keio University in 2005. He came from an economically disadvantaged background where his mother worked while his father was unemployed. Joe his grandfather was an entrepreneur and Joe founded two companies while at university and joined Recruit while still managing one. At the age of 23 he already became CEO of the forerunner of ZIGEnX. Sadly, his father died at an age of 53. Joe realized to get most out of life. Like Brett Kelly of Kelly Partners Group (one of my portfolio positions), he set a goal to meet excellent role models in order to learn from them strategically, but which also might have contributed to business opportunities. In 2009 Hirao did a management buy-out and renamed the company to the current name ZIGExN. This makes Hirao a real owner-operator, as he owns around 48,3% of the shares.

Importantly, Hirao fosters a culture of entrepreneurship within ZIGExN. There is a huge focus on attracting and hiring talented employees and train them internally to become successful entrepreneurs, with the end goal to become a manager of one of the (acquired) subsidiaries.

At a current age of 41, Hirao has a lot of time to continue to grow his business.

Balance sheet, P&L and cashflow

Lets start with reviewing some balance sheet ratios:

Goodwill / equity ratio 0.5x ✅

Current assets > current liabilities ✅

There is a net cash position ✅

Return on invested capital last year of 15% ✅

Weighted average shares outstanding in 10 years ~1% change ✅

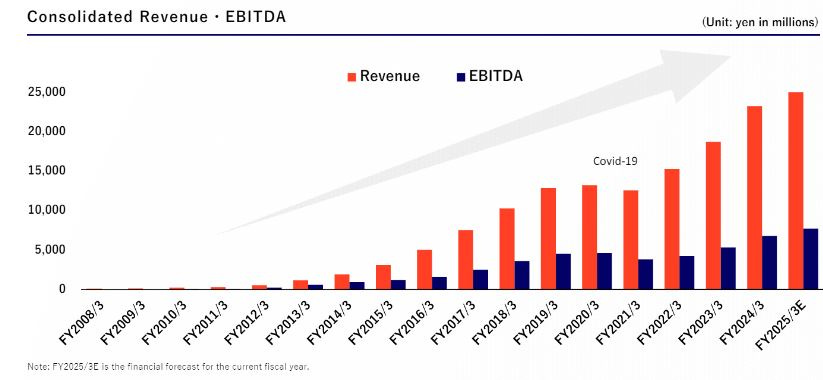

For the P&L I’ll mainly look at growth and margins:

10 year revenue CAGR 28% ✅

Gross margin of 83% ✅

Net margin of 16% ✅

Expected revenue growth next 2 years ~23% ✅

What I like to see is the business expects to continue to grow and that they have high sustainable gross margins, indicating they have pricing power.

Source: ZIGExN new investor deck

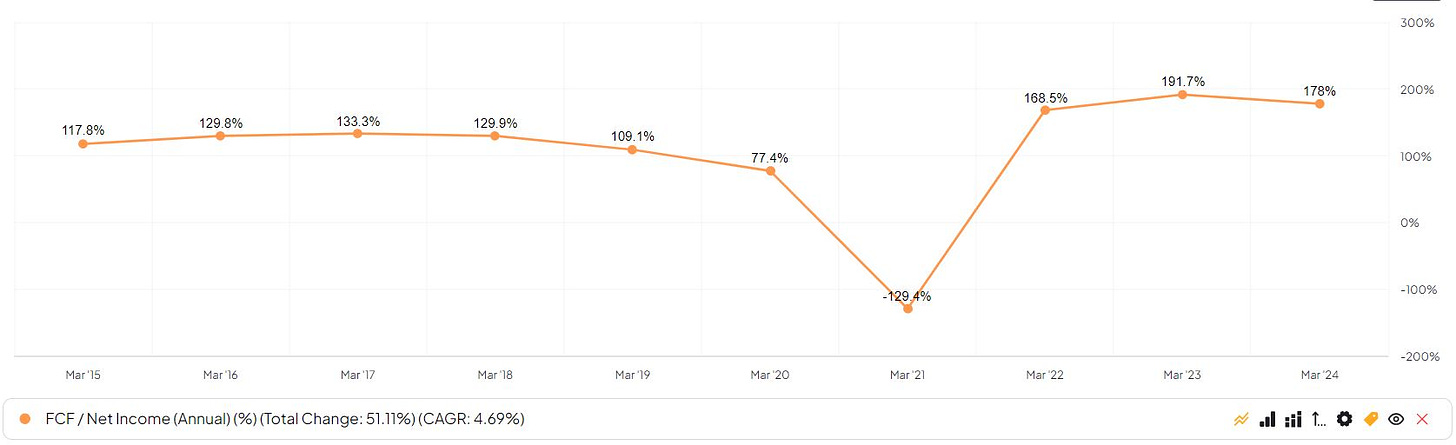

For the Comound & Fire portfolio I like businesses that are able to reinvest most of their income. Most important ratio is:

FCF / net income which in this case is greater than 1 ✅

Source: FinChat

This means ZIGExN on an annual basis can use their net income to reinvest in their business, in M&A, buybacks or dividend.

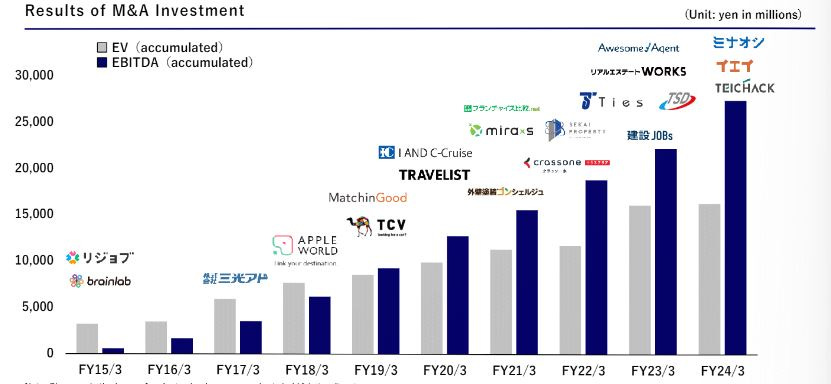

Capital Allocation

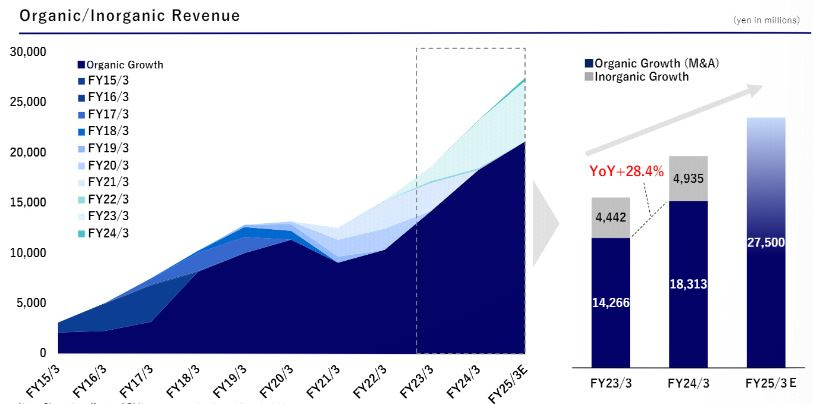

ZIGExN is a serial acquirer so an important part of their cash goes into acquisitions. It’s important those acquisitions add value and below graph is showing they really do.

Source: ZIGExN new investor deck

When a company is acquired by ZIGExN it is also important to see the result of they matching technology system. In their investor deck they are showing that the number of visits is increasing after ZIGExN took over and implemented the matching technology.

Also the payback period is around 4.3 years on average for an acquisition. ZIGExN has a very strict playbook for acquistions, won’t overpay and seeks for opportunities to improve an acquired companies, especially using their core matching system.

After having acquired a company it is important that these companies will also grow organically. The below graph does show this is the case:

Source: ZIGExN new investor deck

Because the current share price of ZIGExN is highly undervalued, ZIGExN announced a 2.8B yen share buyback in 2024, which is around 4% of the outstanding shares. It’s time to go to their valuation now.

Valuation

I will use a discounted cash flow method for the valuation and will use the management targets for 2026 revenue of 35B followed by a 15% increase the next years and a terminal growth rate of 2.5. I think a 15% increase is doable as management expects to significantly grow organically and inorganically. Actually I think the growth could be higher, but because the business is not recession proof as ZIGExN is active in HR and travel, I will stick to 15%.

The EBIT margin I kept consistent at 23% and I have used a tax rate of 30%. The WACC is calculated at 10.7% and this gives me an equity value of 149,149.6 and an implied share price of 1,448.2. With a current share price of 583 yen this means an upside of almost 150%. When adding a margin of safety of 40%, this results in a buy below price of 868 yen. So it makes fully sense for the management to buy back their own shares at this steep discount.

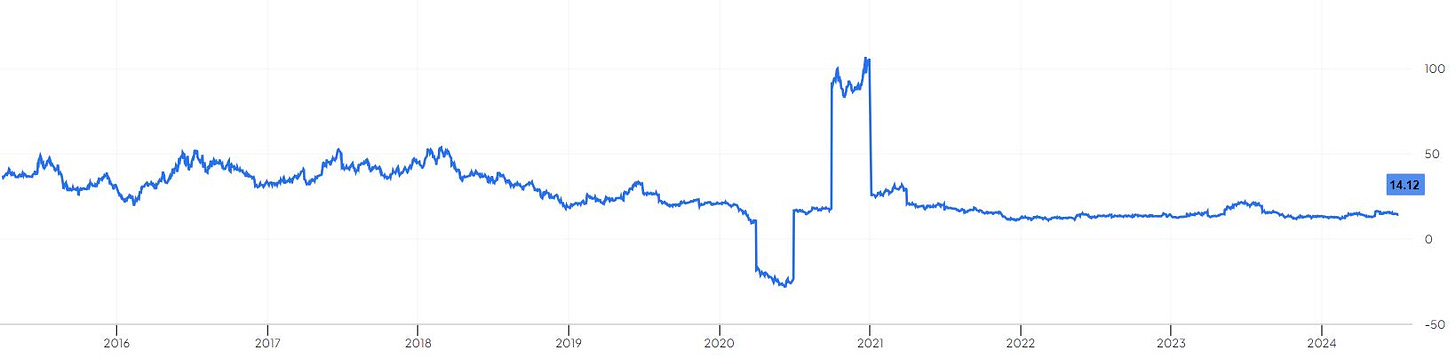

The forward P/E at the moment is 14, where pre-covid the forward P/E was between 19 and 53. This also indicates the current valuation is low.

Source: FinChat

10 years ago the stock price was 575 yen. In the meantime revenue grew 28% per year (CAGR) and diluted EPS 21.8% per year (CAGR). Todays stock price is 583 yen. Stock didn’t move while revenue, earnings and cash flow grew strongly.

For the Compound & Fire portfolio we have bought ZIGExN at a very attractive price of 598.00 yen.

Risks

An overview on the main risks, based on the companies integrated report:

Market Competition: The company operates in a highly competitive online marketplace, which could impact its market share and profitability.

Technological Changes: Rapid advancements in technology may require significant investments to keep up, potentially affecting the company's financial performance.

Data Security and Privacy: As an online business, ZIGExN faces risks related to data breaches and privacy concerns, which could damage its reputation and lead to legal issues.

Regulatory Environment: Changes in laws and regulations governing online businesses and data protection could impact the company's operations and compliance costs.

Economic Fluctuations: The company's performance may be affected by economic downturns, as consumers might reduce spending on discretionary services.

Dependence on Key Personnel: The loss of key management or technical staff could negatively impact the company's growth and innovation capabilities.

Acquisition Risks: ZIGExN's growth strategy includes acquisitions, which carry inherent risks such as integration challenges and potential overpayment.

Platform Dependency: The company's reliance on third-party platforms (e.g., app stores, search engines) exposes it to risks if these platforms change their policies or algorithms.

Brand Reputation: Any negative publicity or customer dissatisfaction could harm the company's brand and affect its ability to attract and retain users.

International Expansion: As ZIGExN expands globally, it faces risks associated with operating in new markets, including cultural differences and local competition.

Intellectual Property: The company's success depends on protecting its intellectual property and avoiding infringement on others' rights.

Cybersecurity: As an online business, ZIGExN is vulnerable to cyber attacks, which could disrupt operations and compromise user data.

Finally the CEO Joe Hirao seems also key for the further development of the company.

Hopefully you have enjoyed this update of my portfolio. Feel free to like the post and share it with friends!

Disclaimer

The information in this article is provided for informational and educational purposes only.

The information is not intended to be and does not constitute financial advice or any other advice, is general in nature, and is not specific to you. Before using this article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

None of the information in this article is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The author is not responsible for any investment decision made by you. You are responsible for your own investment research and investment decisions.