Deep Dive: Watches of Switzerland Group

Last week I have bought a starting position in Watches of Switzerland Group ($WOSG), which has been growing since CEO Duffy leads the company. I like their strategy and current valuation.

Welcome to Compound & Fire! We search for businesses which create strong shareholder value over time in order to get financial independence and retire early. Join for free if you haven’t subscribed yet.

Watches of Switzerland Group is a leading luxury watch and jewellery retailer with strong presence in the UK and a growing footprint in the US and Europe. The company specializes in selling high-end watches from prestigious brands including Rolex, Audemars Piguet, Patek Philippe and many others. It operates a network of multi-brand showrooms and mono-brand boutiques for these and other prestigious brands. In addition to physical stores, the group maintains a robust online presence including platforms like Analog:Shift for vintage and pre-owned watches.

Current Market Situation WOSG

Continued Growth: The group reported a 4% increase in revenue at constant currency for Q4 FY24, with luxury watch revenue specifically growing by 5% at constant currency.

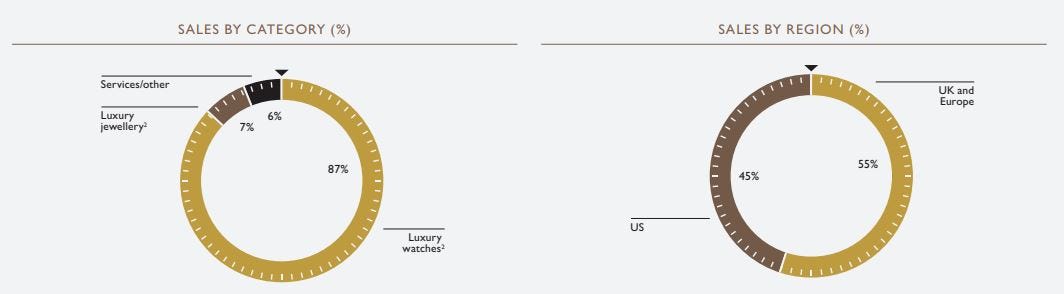

Strong US Performance: The US market showed particularly strong performance, with sales up 14% in Q4 FY24. An overview of the sales by region and category:

Source: Annual Report WOSG

Market Share Gains: The company continues to gain market share in the luxury watch market in both the UK and US, attributed to their differentiated offering.

Demand for Key Brands: There is strong and consistent demand for their key brands, especially for products on the Registration of Interest lists.

Pre-Owned Market Success: The group has seen exceptionally strong performance in the pre-owned watch segment, particularly with Rolex Certified Pre-Owned watches.

Expansion Plans: The company has plans for significant showroom developments, including new Rolex boutiques in London and Texas, an Audemars Piguet Town House in Manchester and an expanded Patek Philippe space in Connecticut.

Cautious Optimism: While the group enters FY25 with cautious optimism, they remain confident in their strategy, client service, and brand relationships to drive growth.

Long-Term Outlook: The company is committed to its Long Range Plan, aiming to more than double sales and Adjusted EBIT by the end of FY28. WOSG wants to surpass 3B pound in revenue and improve margin by 50 to 150 basis points. Revenue growth should mainly come from US (revenue CAGR of 20-25%) and UK (revenue CAGR of 8-10%).

While Watches of Switzerland Group is a significant player in the luxury watch retail market, the recent Rolex-Bucherer deal has created uncertainty and volatility in the stock performance of WOSG. Investors and industry observers are closely watching how this development might impact the company's future growth and market position. More about this deal after the Risk paragraph.

Management - CEO

The CEO of Watches of Switzerland Group (WOSG) is Brian Duffy. Duffy has been instrumental in transforming the company since taking over in 2014. Under his leadership the group has expanded its market presence and is pursuing an ambitious growth strategy.

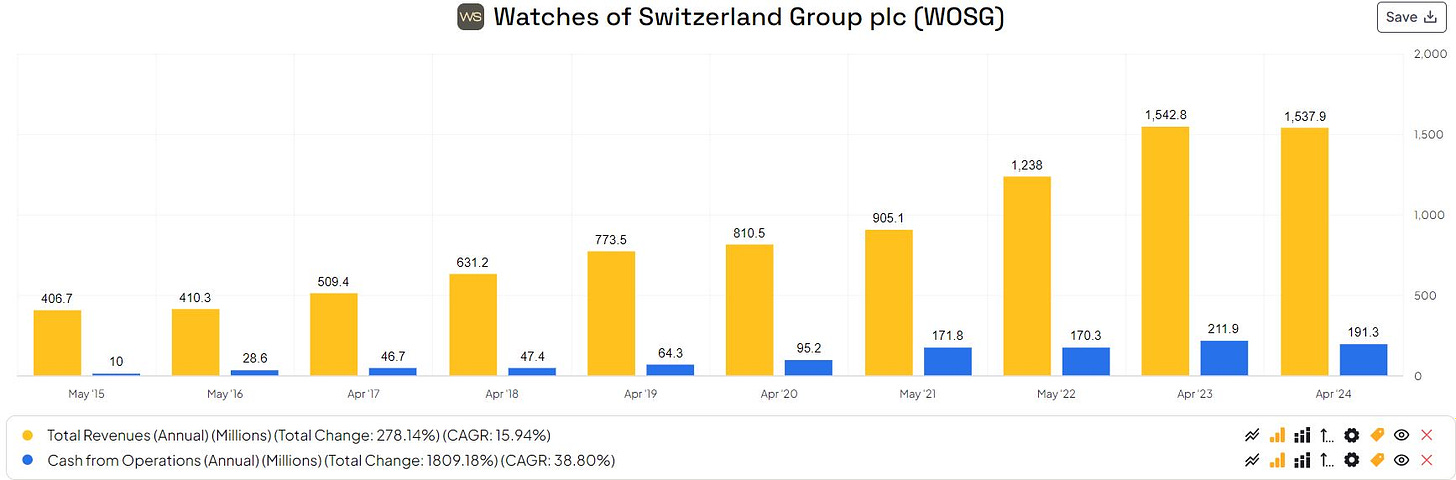

Since Duffy started the revenue has grown by a CAGR of almost 16%, an adjusted EBIT CAGR of almost 44% and operational cash flow increased close to 39%.

Duffy has led the IPO of WOSG in 2019, which elevated the companies profile and helped in retaining top talent through share participation.

Under Duffy's leadership, the company has embraced a balance between physical and digital presence. This includes developing spacious and modern concept stores while also enhancing their e-commerce capabilities. The group doubled its e-commerce in the UK during the covid pandemic.

The US expansion has been key focus for Duffy, making the US a key market alongside the UK. This includes acquiring stores and developing strategic retail footholds in various states.

Also his focus on strong brand partnership has been key. WOSG has partnerships with the following brands:

Source: Annual Report WOSG

I think Brian Duffy's strategic vision and leadership have been pivotal in positioning Watches of Switzerland Group as a leading luxury watch retailer with a robust growth trajectory. A CEO with skin in the game is very important and Duffy has 3.2% ownership in WOSG, which means the interests with shareholders are aligned.

Competitive advantages

WOSG is active in a highly competitive industry where clients can choose the same products in different places. This means it is important to have sustainable competitive advantages:

Number one is the high level expertise and customer service of their empoyees. The group employs over 2,000 colleagues and focuses on providing a best-in-class experience to clients.

WOSG has long-standing associations with prestigious luxury watch and jewellery brands which is a key point of distinction and a cornerstone of their unique client experience. These partnerships are difficult for competitors to replicate quickly.

Extensive Retail Network: With over 150 stores across the UK, US, and Europe, the group has a significant physical presence in key luxury markets.

As mentioned before, the multi-channel approach: The company operates both physical stores and e-commerce platforms, allowing them to reach customers through various channels.

ESG Commitment: The company has a strong focus on environmental, social, and governance (ESG) factors, which can enhance brand reputation and appeal to increasingly conscious consumers.

Market Position: As one of the world's largest luxury watch retailers, the company benefits from economies of scale and significant market presence.

The Expansion Strategy, particularly in the US market. This indicates a growth-oriented approach that can further strengthen its market position.

As said, the industry is very competitive, but this whole set of competitive advantages together makes that WOSG is actively working to sustain and enhance their competitive position.

P&L, Balance Sheet & Cash Flow

Let’s start with the P&L. I have already given the revenue trend and adjusted ebit figures.

Gross and net margins are 13% and 4% respectively. These are typical retail margins, but as mentioned earlier WOSG wants to increase margins by 50-150 basis points.

The average 5 year return on invested capital (ROIC) is 14%.

Shares outstanding have been increasing, but this is due to the covid period. Currently there are 236.8M shares outstanding.

Stock-based compensation as a percentage of revenue has been between 0% and 0.6% last 10 years.

Goodwill stands at 199.3M as per Apr’24 versus an Equity of 523M. This looks sound.

Current assets are almost twice their current liabilities, which means they should have no problems paying their liabilities in the short-run.

Net debt to Adjusted EBITDA is at 0.8 and WOSG wants to stay below 1.0. What I like to read is that their loan facility is linked to the achievement of near-term science-based emission reduction targets and circularity goals. This suggests a commitment to integrating sustainability into their financial agreements.

The last 10 years the cash from operations has always been higher than the net income, something I like to see.

Free cash flow is lower due to capex linked to significant investments which can be seen as growth capex:

Opening 22 new showrooms (growth) and refurbushing 15 existing ones (maintenance)

Expansion of the repairs and servicing capacity, including a new facility in Leicester, which doubles the watchmaking capability in the UK.

WOSG will keep investing in growth capex in 2025 and beyond.

Overall I think their balance sheet is healthy and the cash flows have been increasing with the exception for 2024 due to difficult market circumstances in the luxury segment. September 3, 2024 WOSG announced they are on track to deliver their FY25 guidance and they make progress against their Long Range Plan. This tells the difficult market circumstances seem to get better, which is good news. Stock price went up more than 5%, but this win has vanished with recent market turmoil. Here is a quote from their update last week:

“Demand for our key luxury brands, particularly products on Registration of Interest lists, remains strong in both the UK and US markets, outstripping supply, with consistent additions and conversions. Over the period, we have seen continued stabilisation of the UK market in both luxury watches and jewellery following a period of challenging macroeconomic conditions in the prior financial year. In the first half of FY25, we are increasing showroom stock levels in the US to enhance displays and client experience. As previously indicated, we expect US growth to be second half weighted.”

Source: Trading Update WOSG

Risks

It is always important to look at the risks for an investment in WOSG:

The company faced challenges due to the macroeconomic environment, particularly in the UK market. High inflation and interest rates led to increased cost-of-living pressures for UK consumers, affecting their discretionary spending on luxury watches and jewellery.

The Group's performance is heavily reliant on the luxury watch market, which can be subject to fluctuations in demand and supply. The UK market, in particular, experienced a period of normalization following a COVID-induced boom.

The strength of the Swiss Franc led to significant price increases from luxury watch brands, potentially impacting consumer demand.

While the US market showed strong growth, the UK market experienced a decline. This highlights the risk of geographic concentration, with the company's performance being significantly affected by regional economic conditions.

The luxury watch industry is characterized by supply-driven dynamics, with demand often exceeding supply for key brands. This could potentially limit growth opportunities if supply constraints persist.

The company operates in a market with high barriers to entry, but maintaining market share and competitive advantage requires continuous investment in showroom enhancements, strategic acquisitions, and client experience initiatives.

The company's Long Range Plan involves ambitious growth targets, including more than doubling sales and Adjusted EBIT by the end of FY28. There's a risk associated with the successful execution of this strategy, particularly in new areas like luxury branded jewellery (this is why I will calculate with a lower growth versus Long Range Plan).

Brexit-related changes, such as the withdrawal of VAT-free shopping for tourists in the UK, have impacted the company's business, highlighting the potential risks from regulatory and political changes.

While these risks are present, it's important to note that the company has demonstrated resilience and continues to gain market share in key markets despite challenges. The company's diversification into the US market and its strong brand partnerships also serve as mitigating factors for some of these risks.

Acquisition of Bucherer by Rolex

On top the Bucherer acquisition by Rolex could impact some of these risks as well. It could potentially lead to increased competition in the luxury watch retail market. Watches of Switzerland Group has a strong partnership with Rolex, but the Bucherer acquisition may alter the competitive landscape. There's also a risk that the acquisition could impact the supply of Rolex watches to other retailers like Watches of Switzerland. The annual report mentions that "Demand continues to exceed supply for key luxury watch brands", indicating that any changes in supply dynamics could be significant.

Rolex's acquisition of Bucherer does represent a significant move towards more direct control over retail sales, but with some important nuances:

Increased retail presence: By acquiring Bucherer, which has over 100 sales outlets worldwide (53 of which distribute Rolex), Rolex gains a much larger direct retail footprint.

Maintaining independence: Rolex has stated that Bucherer will keep its name and continue to operate independently, at least initially. This suggests Rolex is not immediately converting all Bucherer stores to Rolex-only boutiques.

Strategic control: The acquisition gives Rolex greater control over a major distribution channel and access to valuable customer data and insights.

Vertical integration: This move represents a form of vertical integration for Rolex, allowing them to have more influence over the entire sales process and customer experience.

Potential shift in strategy: While Rolex has traditionally relied on authorized dealers, this acquisition marks a significant departure from that model and could signal a longer-term shift towards more direct-to-consumer sales.

Industry impact: The move is seen as potentially reshaping dynamics between watch brands, authorized dealers, and consumers across the luxury watch industry.

Preserving partnership: Rolex framed the acquisition partly as a way to preserve its long-standing partnership with Bucherer, following succession planning challenges for the Bucherer family.

While Rolex is not immediately transitioning to a fully direct sales model, this acquisition does give them significantly more control and options for direct retail in the future. It represents a major step in that direction, even if executed gradually and while maintaining Bucherer's existing multi-brand structure for now.

In my opinion if Rolex even wants a next step in a fully direct sales model, they will have to acquire another luxury watch retailer. This could be WOSG or one of their competitors. Till that time, I don’t think a lot will change for WOSG, however the markets is afraid it will and hence share price has fallen significantly. WOSG wants to grow their market in US, which is mainly Bucherer’s market. Future will tell the impact to WOSG, but in my opinion current valuation gives an opportunity for an investment in WOSG.

Valuation

For my valuation I have used a 3% increase for the first year and a 10% increase for the next 9 years, which is much lower versus management growth plan. For WOSG my desired return is 10% per year and the perpetuity growth rate is 2.5%. This results in a fair value of 9.78 GBP, which is more than twice the current valuation. So there is a wide margin of safety and my buy below price is 5.86 GBP.

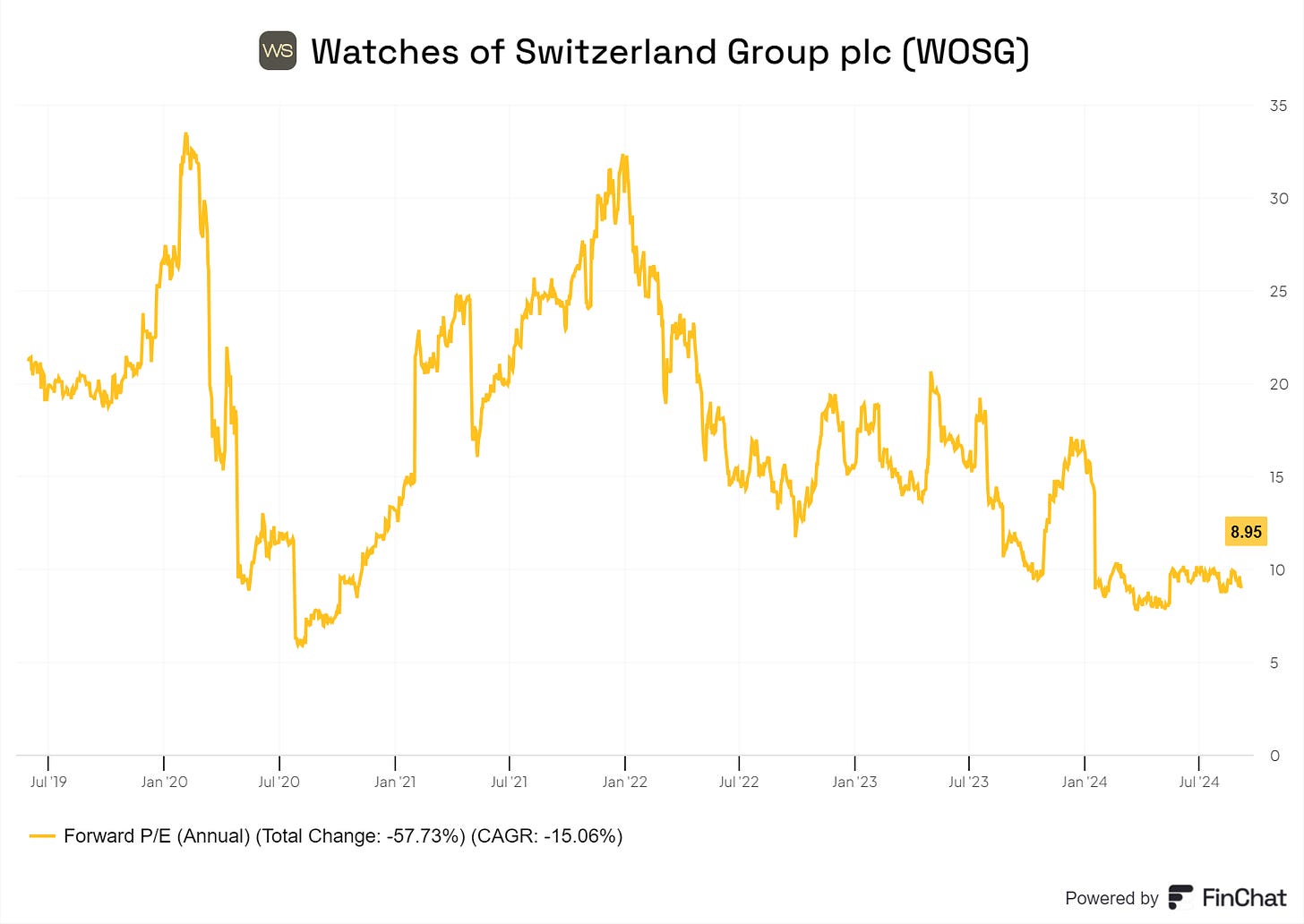

The forward PE is currently just below 9, which is very low compared to the past:

Source: Finchat

Given the historical revenue CAGR, the major expansion plans in US, the strategic acquisition of US Jeweller Roberto Coin and the significant growth potential of luxury branded jewellery, my growth forecast might be at the conservative side. Given all the negative news currently priced in and the low valuation I think the risk to lose is low, while the potential upside is high. The beta is high at 2.16 and that is why it will be my smallest position, just below 5% of my portfolio.

Hopefully you have enjoyed this deep dive. Feel free to like the post and share it with friends!

Disclaimer

The information in this article is provided for informational and educational purposes only.

The information is not intended to be and does not constitute financial advice or any other advice, is general in nature, and is not specific to you. Before using this article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

None of the information in this article is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The author is not responsible for any investment decision made by you. You are responsible for your own investment research and investment decisions.

from when on do they want to double the revenue? from 2024 to 2028? :D