Picture: Yujie Chen

As a quality investor I invest in companies with the following quantitative and qualitative criteria:

Market leadership

Competitive advantages / companies with a moat

Strong and trustworthy management

Pricing power

Recession proof businesses

A track record in growth and profit

A high Return on invested Capital or Return on Equity

Strong free cash flow generation

A healthy balance sheet with low debts

An attractive valuation

These companies will create shareholder value overtime if they allocate their free cash flow in the right way and they will reduce my risk as an investor. Today I will analyze Rightmove PLC and will touch on above criteria and will add a risk section on top. In my opinion current stock price is an attractive entry point and I have add Rightmove to my portfolio. Continue reading to find out why this stock is a high quality business and ticks the boxes.

Market leadership & competitive advantage

Rightmove is the UK’s unrivalled online digital property advertising and information portal. In the UK it has a strong position and market share.

“The core business of Rightmove is having property professionals such as estate agents, letting agents ad new home builders pay a subscription fee to advertise their properties on Rightmove. This includes digital advertising products and tools to increase the agents profiles, differentiate themselves from their competition and access Rightmove’s market profiles data. Extensive property market data is sold to a range of customers, among others agents, landlords, surveyors and insurers. Through Rightmove’s partners they provide mortgage in principle and broker services to consumers who want to gauge affordability, which generates commissions when the mortgage completes. Finally they also sell advertise banners to a range of businesses.” (source: Rightmove Annual Report 2023)

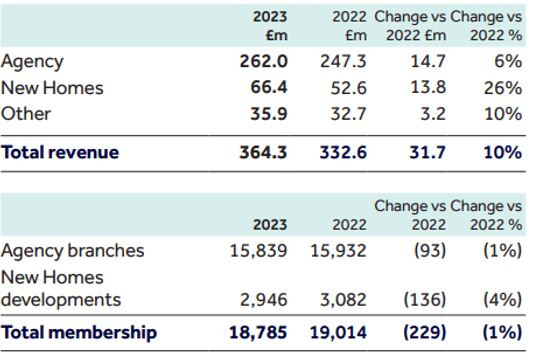

The revenue is split over Agencies, New Homes and Other:

For Agency branches you can see that the number of agencies dropped slightly with 1% and the number is flat to declining for a number of years. This is linked to the current economic conditions in the UK and a bit of consolidation within the agency branches. I have asked Rightmove how they see this trend of consolidation and declining agency branches and they confirm they are vigilant but they don’t see significant risk from agent consolidation. Also they are hopeful that economic conditions will improve as in their Annual Report they see some “tailwinds:

shortage of housing stock relative to demand

growing population

increasing lifespans

increasing real estate values

ever increasing digital adoption”

If the growth in agencies is flat or declining, how does Rightmove increase their revenue in this segment? The Average Revenue per Advertiser (ARPA) is a reflection of the value Rightmove is delivering to their customers. In 2023 60% of the ARPA growth was due to product improvement / innovation, where customers upgraded their package or paid for additional products. The other 40% was the result of price increases. Rightmove says these price increases occur steadily and carefully every year and they have a pricing discussion with about one-third of their agent base. The average independent agent sees a price increase of around 8%. Future growth in the core segment is seen from growth through products and the steady compounding price increases.

“Regarding the digital adoption 93% of the UK population are aware of Rightmove and 3x more people say they turn to Rightmove to look at property online than their nearest competitor” (source Rightmove market tracker). Morgan Stanley included Rightmove in their list of companies with a wide moat. Rightmove is in a winner-takes-most market.

The time spent on Rightmove versus their nearest competitors (which are Zoopla.co.uk, OnTheMarket.com and PrimeLocation.com) last couple of years increased from 70-80% between 2015-2019 towards 80-90% between 2019-2023.

Source: Rightmove Investor Day presentation

In October 2023 the CoStar Group announced the acquisition of competitor OnTheMarket.com. Although CoStar will give OnTheMarket (OTM) more financial power and cash to invest in sales and marketing it will be very difficult to change the Moat of Rightmove. I have investigated a couple of wins OTM has announced recently where agencies started publishing on their site, but after contacting these agencies, all of them kept publishing on Rightmove. As all consumers know Rightmove and will start their search there, it is a must for agencies to publish on Rightmove.

Also in the past (around 2018) competitors gave agencies free space on their platform to grow their supply. When these agencies had to start paying, they chose the platform known by most consumers and this is Rightmove. So this shows that agressive marketing by OTM is not moving awayagencies from Rightmove.

Management & strategy

Since February 2023 Rightmove has a new CEO: Johan Svanstrom. It is difficult to judge a CEO after one year. Johan Svanstrom brings relevant experience into his job as CEO. He recently worked as a Partner for EQT, a Swedish private equity firm. And prior he served as global president of Hotels.com and Expedia Affiliate Network. Svanstrom says: “Rightmove has a long runway of opportunities to innovate, digitise and create ever more value for users, customers, and the wider eco-system.” (source: UK property site Rightmove targets expansion in appointing new chief (ft.com))

The stock based compensation for Rightmove is 1,6% of the revenue, which isn’t too high and below my level of acceptance. Also clear targets are set for management, related to underlying operating margin and strategic targets like traffic market share, mortgage revenues and employee engagement.

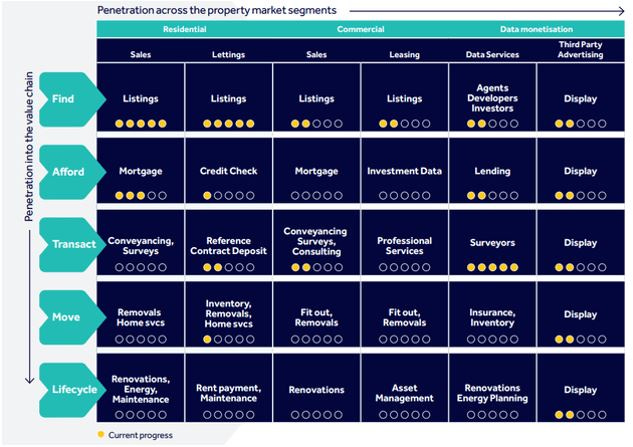

The Investor Day of November 2023 shows exactly where management is focusing on. I really like their strategic model for growth. It shows in a terrific way which opportunities Rightmove has and which segments they are currently monetizing. As you can see there is a lot to win for Rightmove.

Source: Rightmove Annual Report 2023

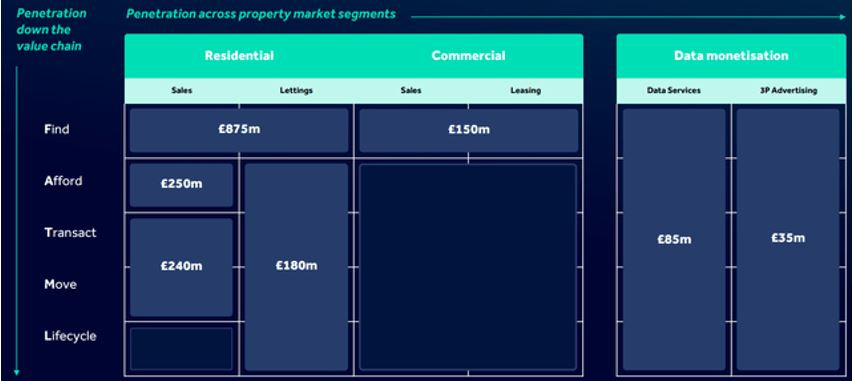

The corresponding revenue opportunity for each segment:

Source: Rightmove Investor Day presentation

The annual report of Rightmove shows the position and progress for the strategic pillars during 2023, for which Consumer and Core Customers are linked to the 875M opportunity shown above. The Strategic Pillars are linked to the Financial and Rental Services (250M and 180M) and commercial (150M) opportunities.

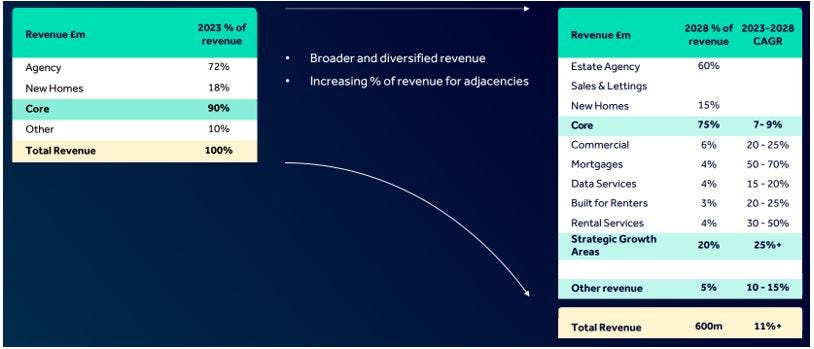

Management sees main growth in the Strategic Growth Area with a CAGR revenue of 25%+. But also the current Core is expected to grow between 7-9%. Below you can find the current revenue split and the expected future revenue split.

Source: Rightmove Investor Day presentation

This information is great to track the progress of management in each segment. Coming years I will monitor this closely. Especially the Strategic Growth Areas could give potential further upside.

Track record and ROIC

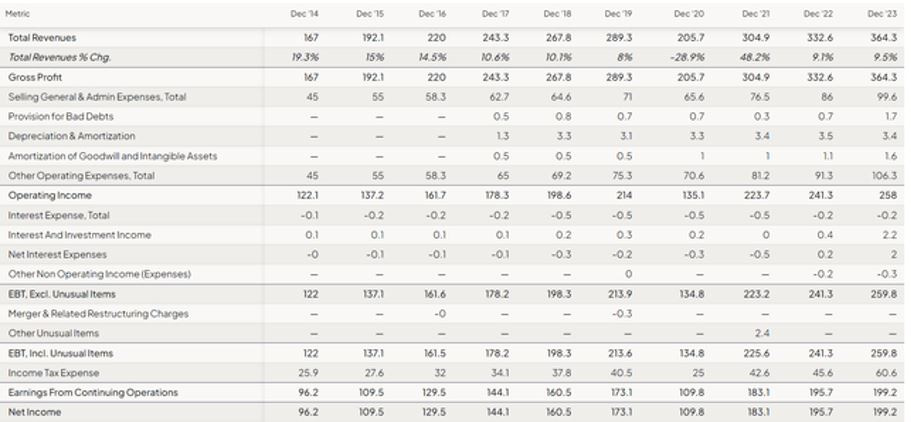

Since 2014 Rightmove has been growing year-over-year, except for 2020 which is related to Covid. The Revenue CAGR for these years is 9% and the net income CAGR is slightly lower at 8,4%. As Rightmove continuously has a share buyback program, the earnings per share were growing on average with 10,7% which is higher than the growth in revenue. The company is clearly growing revenue and net income over time.

Source: fintech.io

The ROIC has always been above 200% the last ten years. The weighted average cost of capital for Rightmove is 10,2%. Important is the ROIC is higher than the WACC so Rightmove is generating value for us. The ROIC is very high and not a good metric as Rightmove doesn’t need a lot of assets to generate income. The cash generated is given back to shareholders through dividend and share buybacks. On one hand it’s a pity they can’t return the cash in the business, on the other hand it’s great they are using it for share buybacks and potential M&A.

Free cash flow & balance sheet

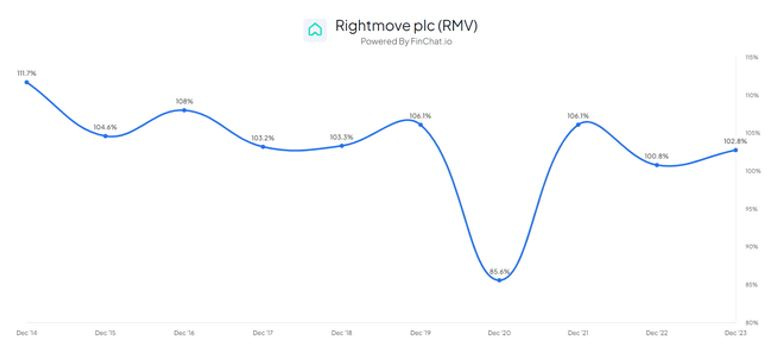

Except for COVID year 2020 their free cash flow have outpaced their net income every year. This means their capital expenditures have been very low and Rightmove hardly needs cash to run their business. See below graph of free cash flow / net income metric:

Source: finchat.io

If they don’t need cash for their own business, they can use it for M&A or give the cash back to shareholders. For 2024 management has announced a clear investment plan for an incremental 10M GBP. Also bolt-on M&A is part of their strategy. Earlier this year they have announced the acquisition of HomeViews Platform for 8M GBP. HomeViews is the UK's biggest community of verified resident reviews of property developments, with a particular focus on the build to rent sector. As shown earlier, the Build for Renters is an important part of the Strategic growth area and Rightmove strengthened this segment with a small acquisition.

Both the incremental capex and the acquisition I will consider in my valuation, but outside 2024 I will assume most free cash flow to be returned to shareholders. Total return in 2023 to shareholders was 201,7M versus a free cash flow of 204,7M. This was split in share buyback (130M) and dividend (71,7M). On a market cap of 4B the share buyback is 3,25% and the dividend is 1,8%.

Now let’s have a look at their growth in the last ten years. Their 10YR revenue CAGR has been 10%. Using the guidance of management for a revenue of 600M plus in 2028, this means management expects revenue to grow in at least the same pace. The first two years revenue growth is expected at 9% and for 2026 -2028 this is 12%. A growing business is what we want to invest in. Even better if the company has healthy margins. Their operating margins are expected to be over 70% with a net income margin of around 54%. This is truly growth with outstanding margins.

Finally Rightmove has a very healthy balance sheet with a negative net debt of 31M GBP. So they have a net cash position which is beneficial in a higher interest rate environment. Also their goodwill position is not out of balance compared to their equity: 16M goodwill versus 69M equity.

Valuation

I think management laid down a clear strategy and should be able to achieve the growth in revenue and with 70% operating margins. I will use a conservative 7% growth the first year, 9% growth for the second year and 12% growth for the 3 years after, so in 2028 I end up with 597M revenue, just below management expectations of 600M plus revenue.

I first use the discounted cash flow method to get to the equity value. In my model I have used a WACC of 9,3% and a long-term growth of 3%. My equity value comes to 4.410M compared to a market cap of around 4.120M. So this means a discount of 7% as per current market valuation.

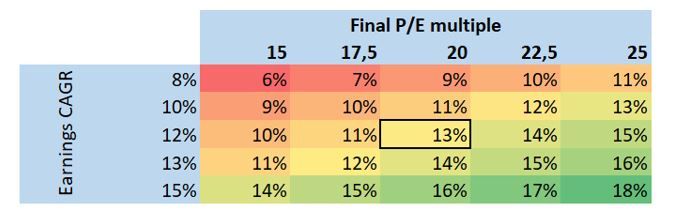

The corresponding P/E based on 2023 actual earnings is 22,1. When I project future earnings till 2028 and I take a conservative P/E of 20,0 I arrive at a stock price of 8,95 by the end of 2028. Based on todays share price this means a CAGR of 11,5%. When I add up the 2% yearly dividend, this means a projected yearly result of 13,5%. Dividend tax in UK is 0%, so no dividend leakage here. I think this is a quite conservative base case, especially taking into account the historical forward P/E as shown below:

Source: finchat.io

Plotting variable earnings CAGR and final P/E’s in the heatmap below gives an indication what the return will be if earnings CAGR or final P/E is different from the expected 13,5% and 20,0 respectively.

Source: created by author

The more negative scenario, which I don't expect to happen, with an earnings CAGR of 7,5% and a P/E of 17,5, still gives 7% annual return. The base case is 13% annual return, but the upside when more revenue comes in for Strategic Growth Areas and the P/E returns to prior levels, then 16-18% could become reality.

Risks

Finally it is good to shortly go over the risks associated with an investment in Rightmove:

Rightmove derives almost all its revenues from the UK and is therefore dependent to a certain extent on the prevailing macroeconomic conditions in the UK housing market and on consumer confidence. Both can influence the number of property transactions in a given year.

A severe and prolonged recession could reduce the customer base and negatively impact revenues.

Rightmove operates in a competitive marketplace with attractive margins and low barriers to entry, which may result in increased competition from existing competitors or new entrants.

They operate in a fast moving online marketplace. Failure to innovate or adopt new technologies and failure to adopt to evolving consumer behavior may impact the ability to offer the best products and services.

An increased risk associated with external cyber-attacks which could result in an inability to operate Rightmove’s platforms.

Success is dependent on the ability to attract, recruit and retain highly skilled workforce.

All of the above mentioned risks are part of the risk framework of Rightmove. For each single item they are monitoring and mitigating the risk. E.g. the ability to attract and retain skilled workforce: Rightmove has a score of 88% in their “Great Place to Work”, which means employee sentiment is strong.

Summary

Rightmove is mentioned as a wide moat company by Morgan Stanley and UK population ranks Rightmove as the number 1 property platform

Rightmove hardly needs cash to run their business

Net income margin >50% and expected growth coming years of 10,5% revenue CAGR

High shareholder returns due to high free cash flow

Competitor OnTheMarket acquired by CoStar is a low risk given the strong moat of Rightmove

Clear strategy communicated in November 2023 and line of sight towards growth

Risk framework in place to monitor and mitigate potential risks, however Rightmove is dependent on the UK macroeconomy

At the current share price I expect a yearly return of 13,5% for the next 5 years, considering a PE of 20, which is at the lowest level since last 10 years.

I see limited long-term downside because of the moat protection, but potential upside resulting in a yearly return between 16-18% from today’s share price of 520.

Let me know whether you liked this article or if you have any questions or suggestions.

Disclaimer

The information in this article is provided for informational and educational purposes only.

The information is not intended to be and does not constitute financial advice or any other advice, is general in nature, and is not specific to you. Before using this article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

None of the information in this article is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The author is not responsible for any investment decision made by you. You are responsible for your own investment research and investment decisions.